Employees and employers can choose to contribute EPF at a higher rate than the minimum contributions specified in the EPF Contribution Table. However, they must get approval from KWSP before increasing the contributions.

How to apply to KWSP to increase the EPF employee contribution rate

If an employee opts to contribute at a rate exceeding the statutory rate, they should complete and sign Form KWSP 17A (AHL) and submit the form to their employer to confirm the rate they want to increase their contribution to. The form should be kept by the employer for record purposes.

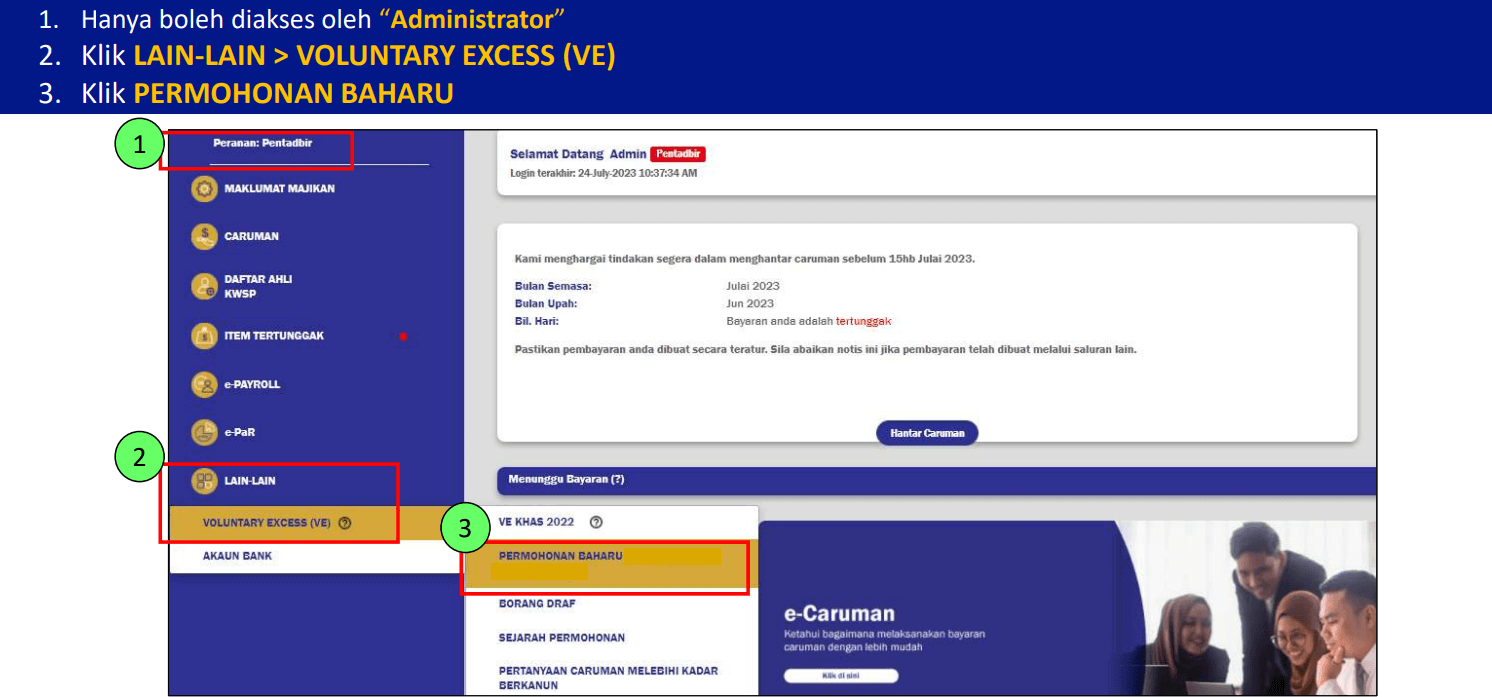

The employer should then apply to increase the employee contribution via their Employer iAkaun. Under the Peranan: Pentadbir tab, click on LAIN-LAIN > VOLUNTARY EXCESS (VE) > Permohonan Baru.

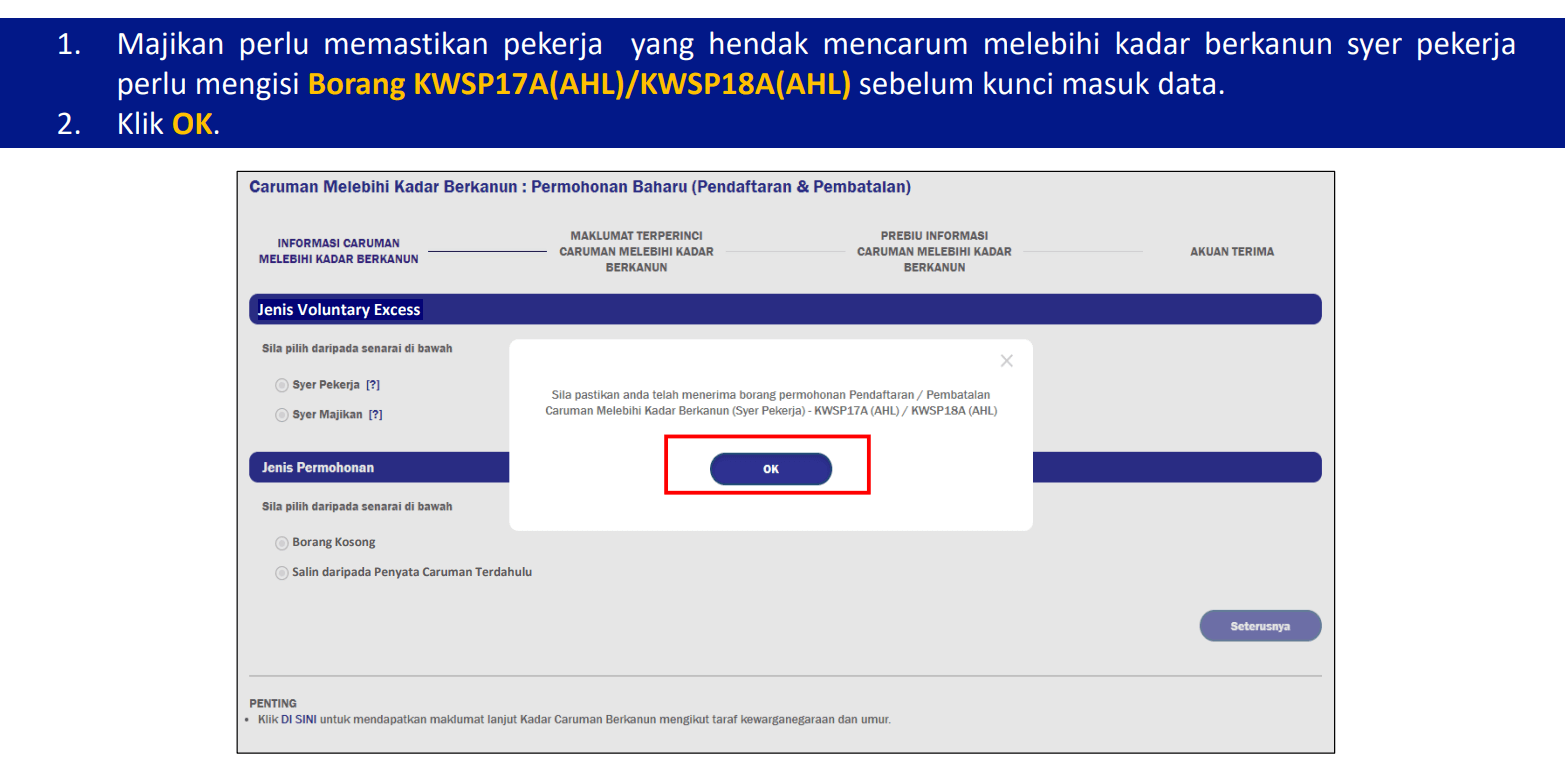

Employers will then need to confirm that they have received Form KWSP 17A (AHL) from their employee by clicking on OK.

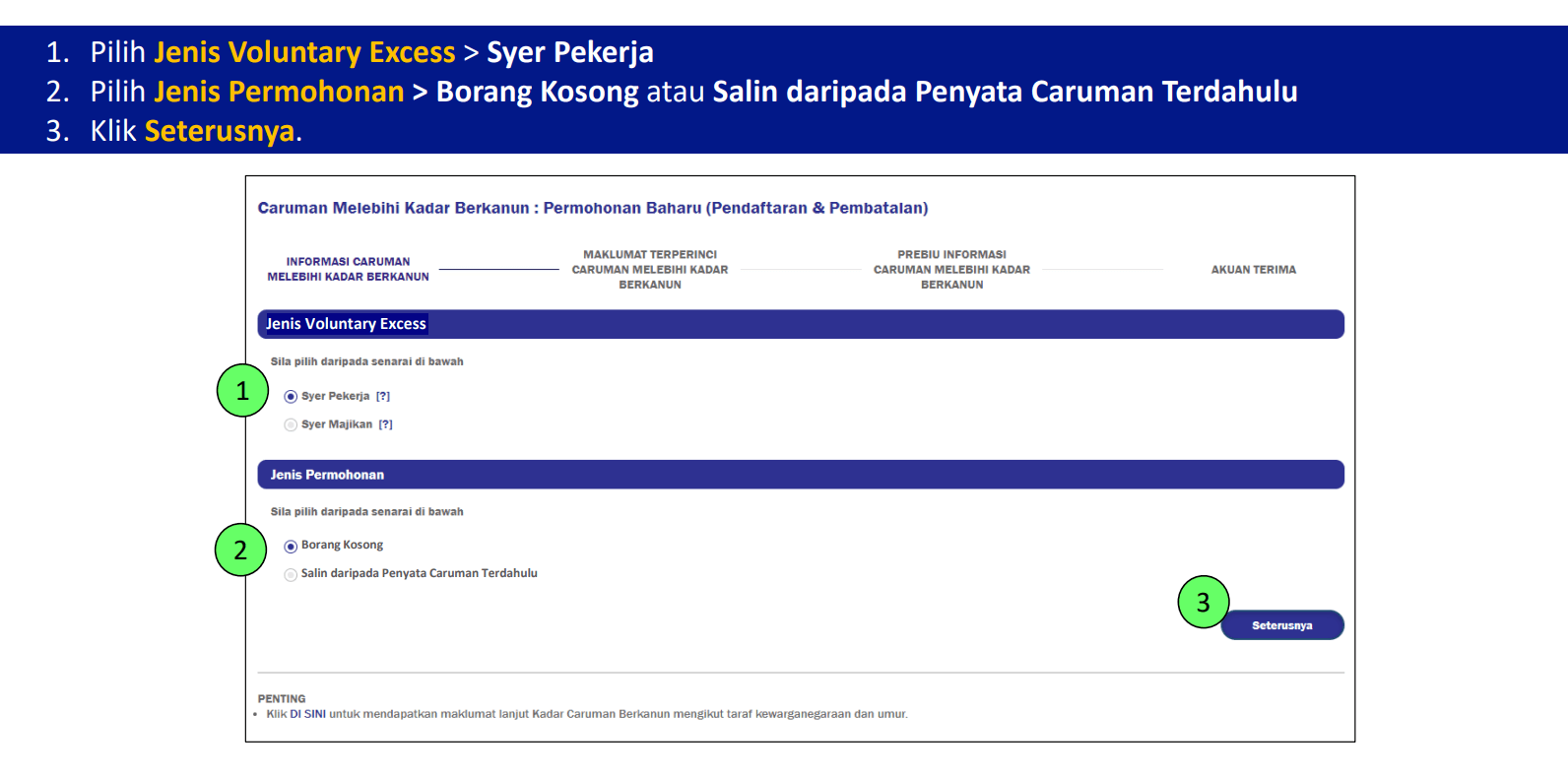

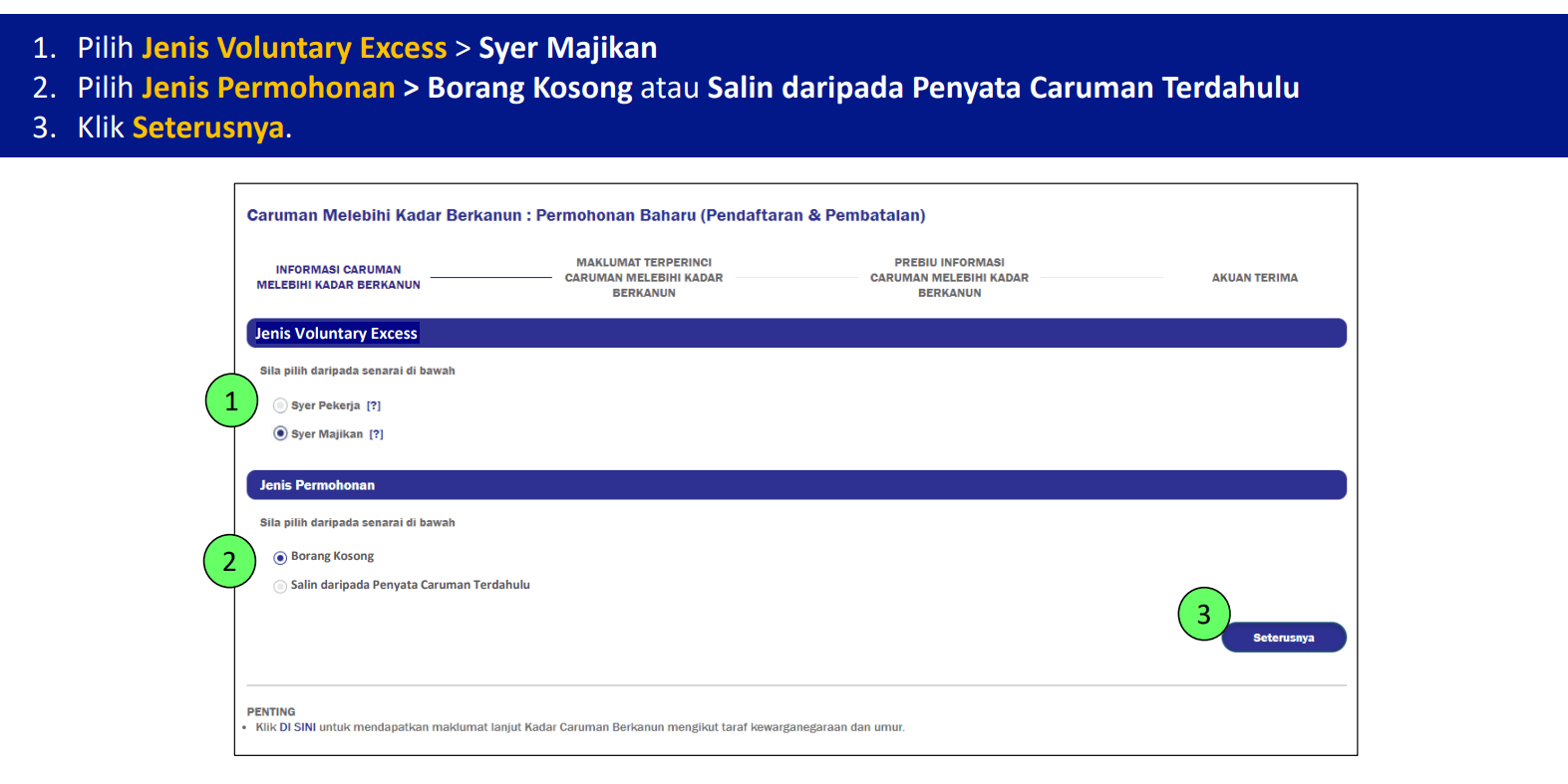

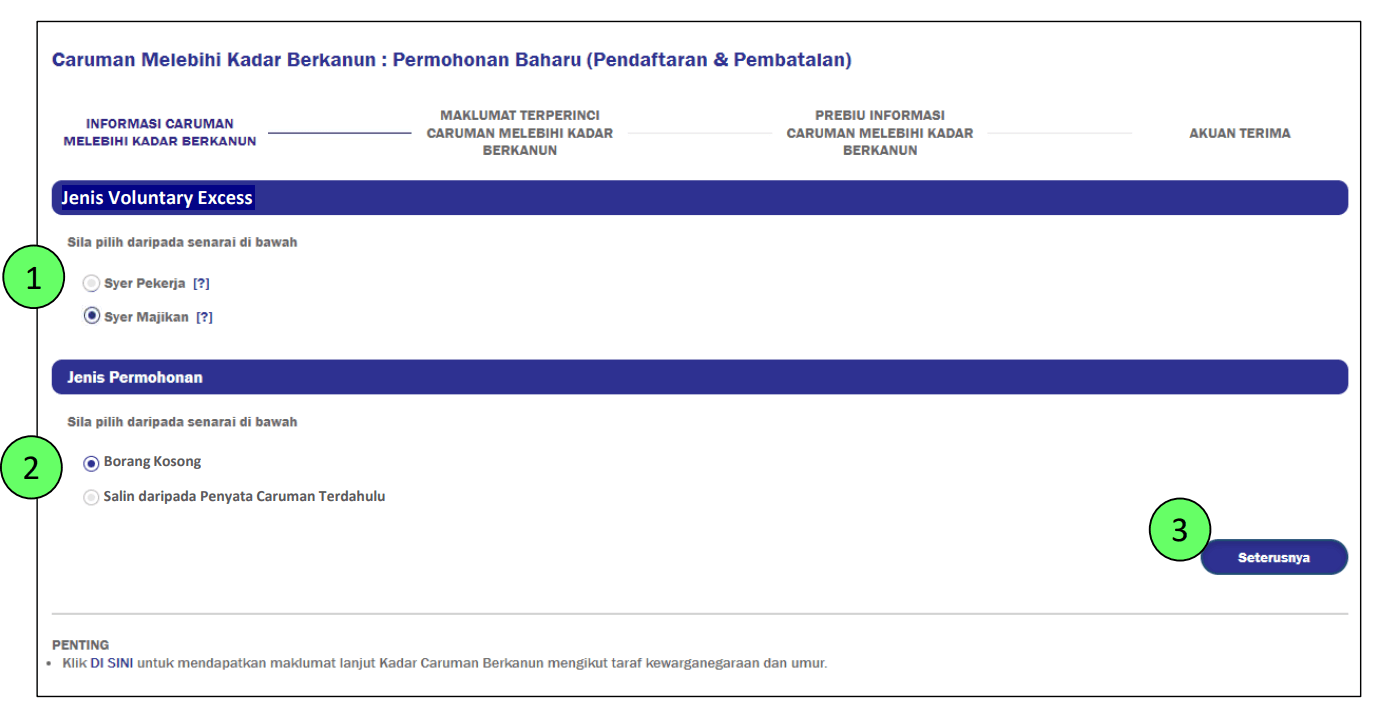

Next, select Syer Pekerja under Jenis Voluntary Excess and Borang Kosong (you will have to add the employee by clicking on Tambah Pekerja) or Salin daripada Penyata Caruman Terdahulu (a list of your employees from your last contribution submission will appear and you will be able to delete any employees) under Jenis Permohonan. Click on Seterusnya to continue.

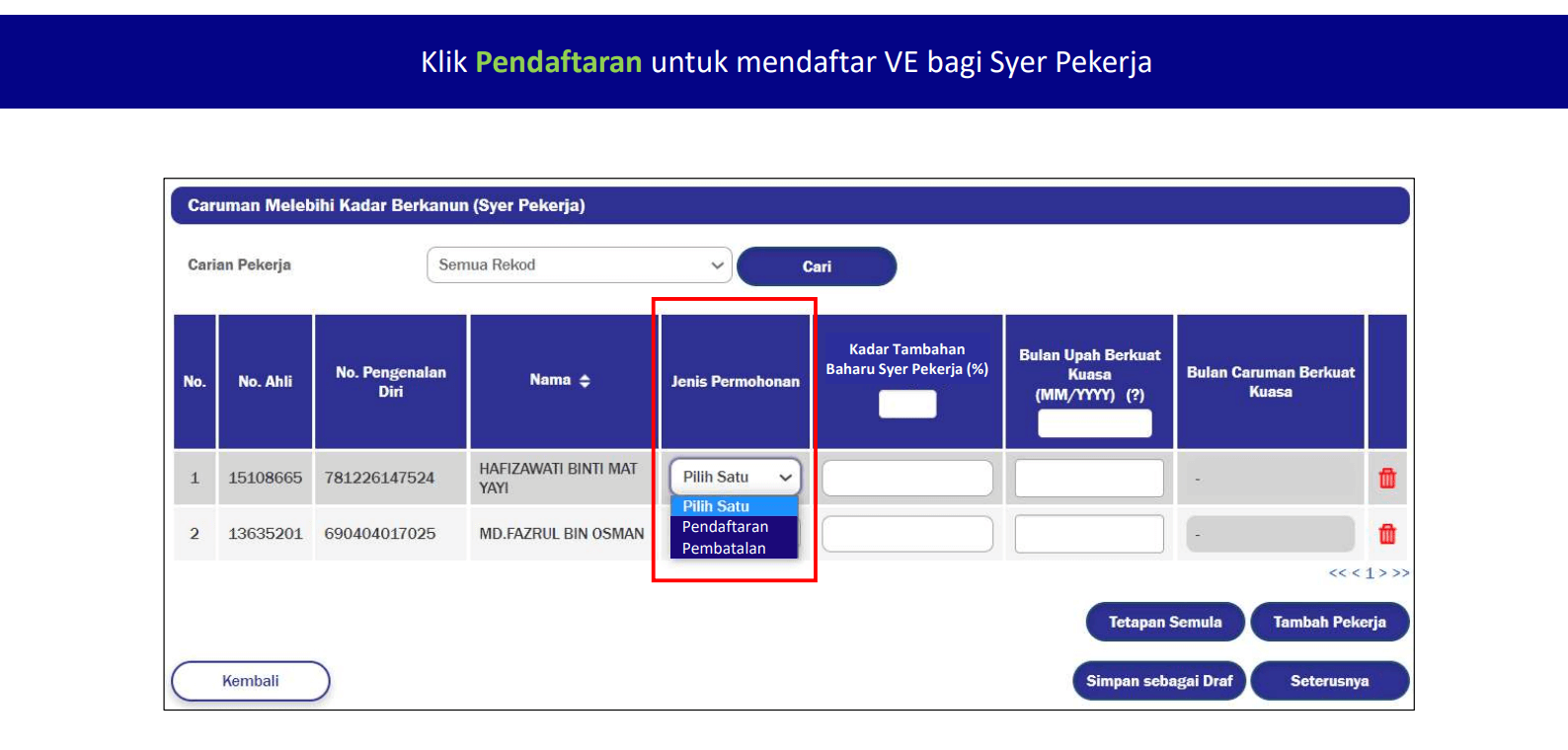

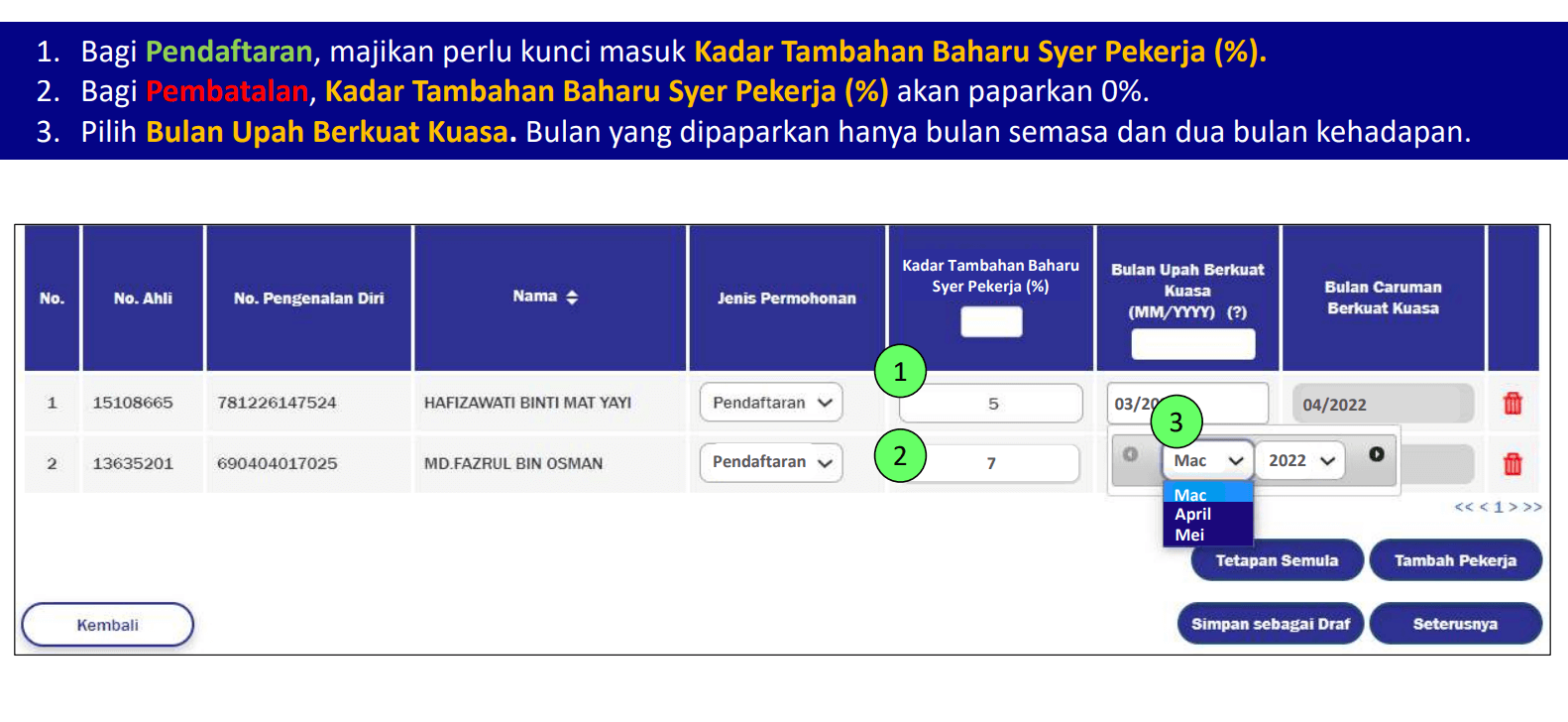

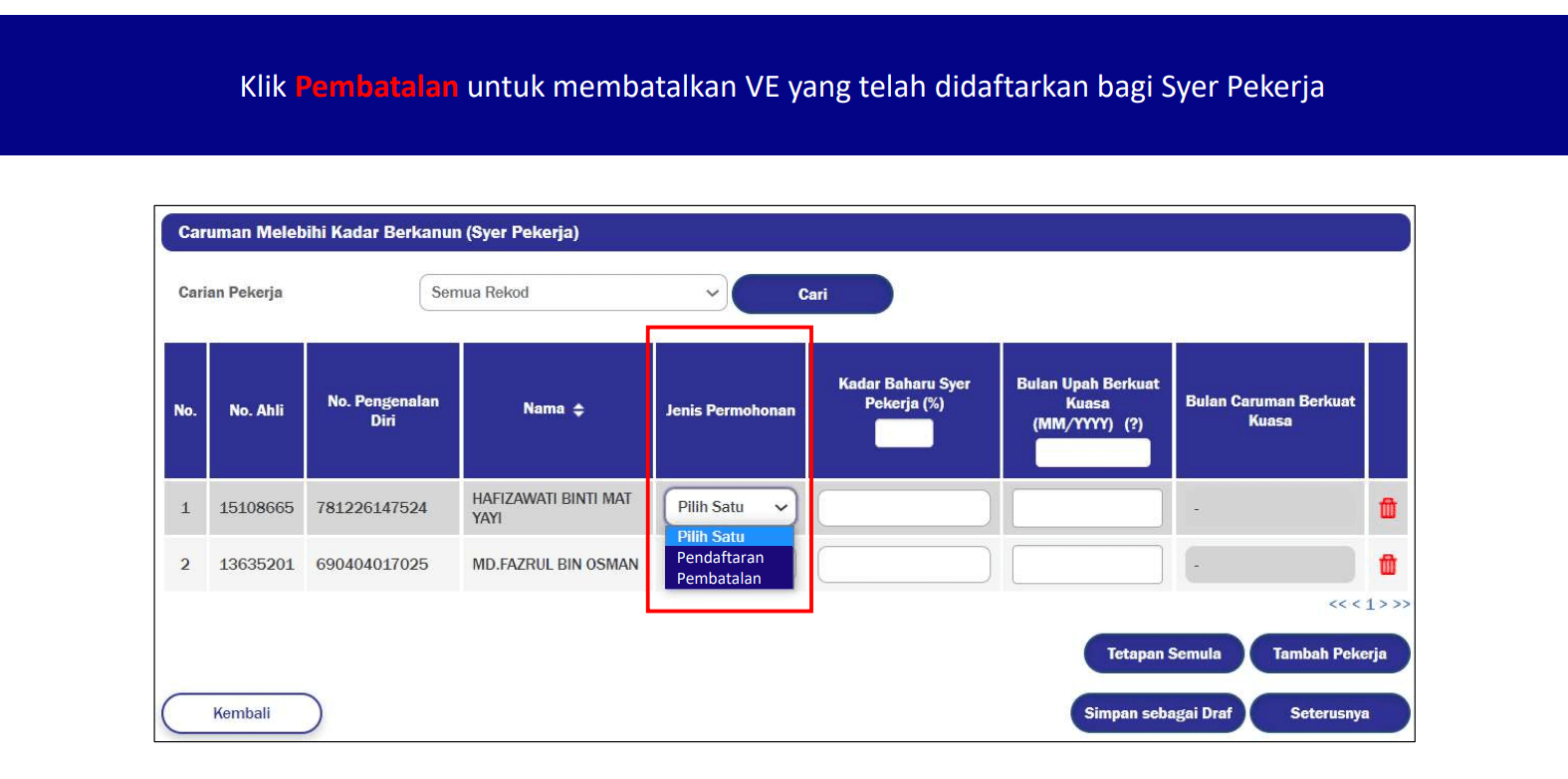

Select Pendaftaran under Jenis Permohonan.

Employers should then key in the additional employee EPF contribution rate (%) the employee wishes to contribute and the effective wage month for the additional contribution rate. Click on Seterusnya to proceed.

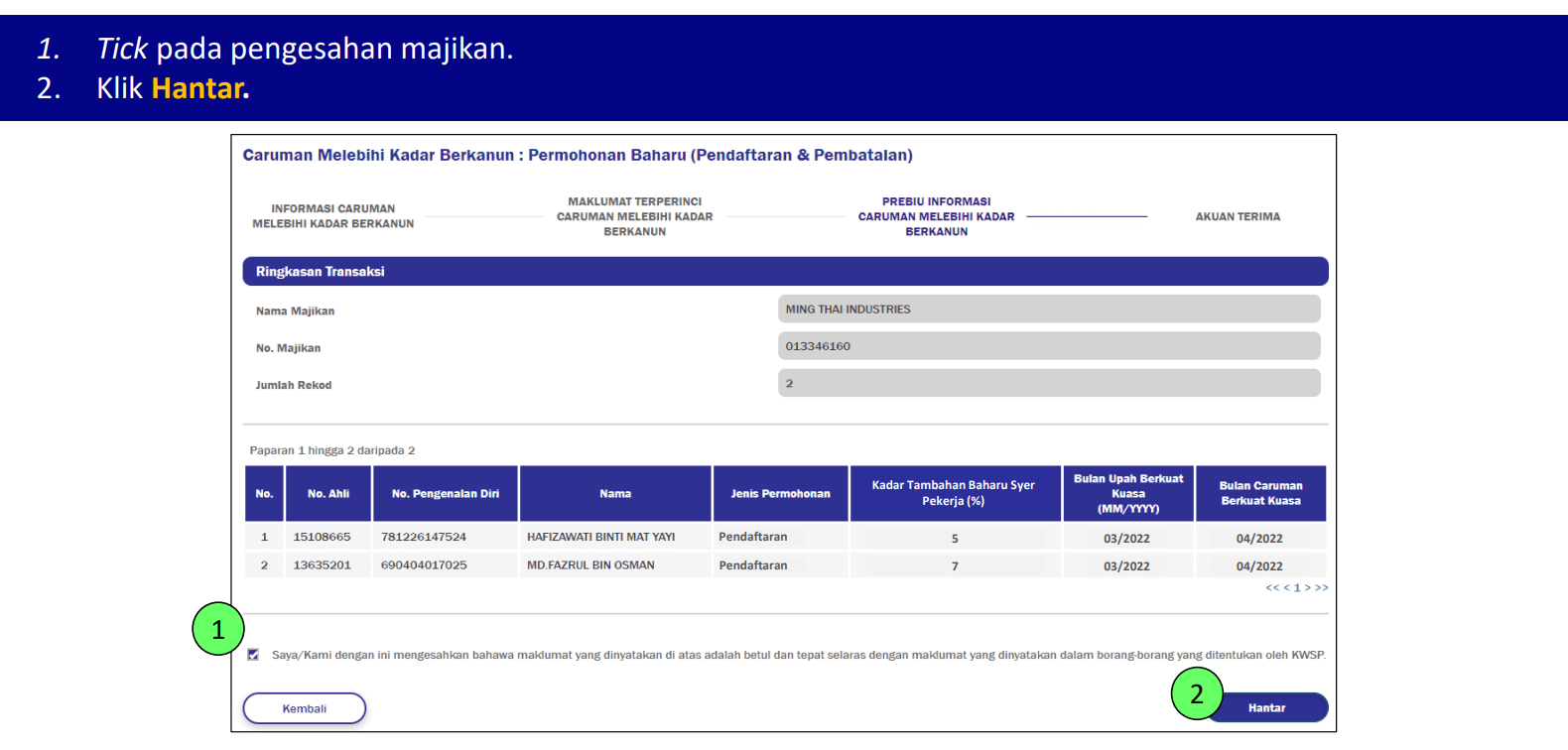

Tick the verification statement at the bottom of the page and click on Hantar to submit.

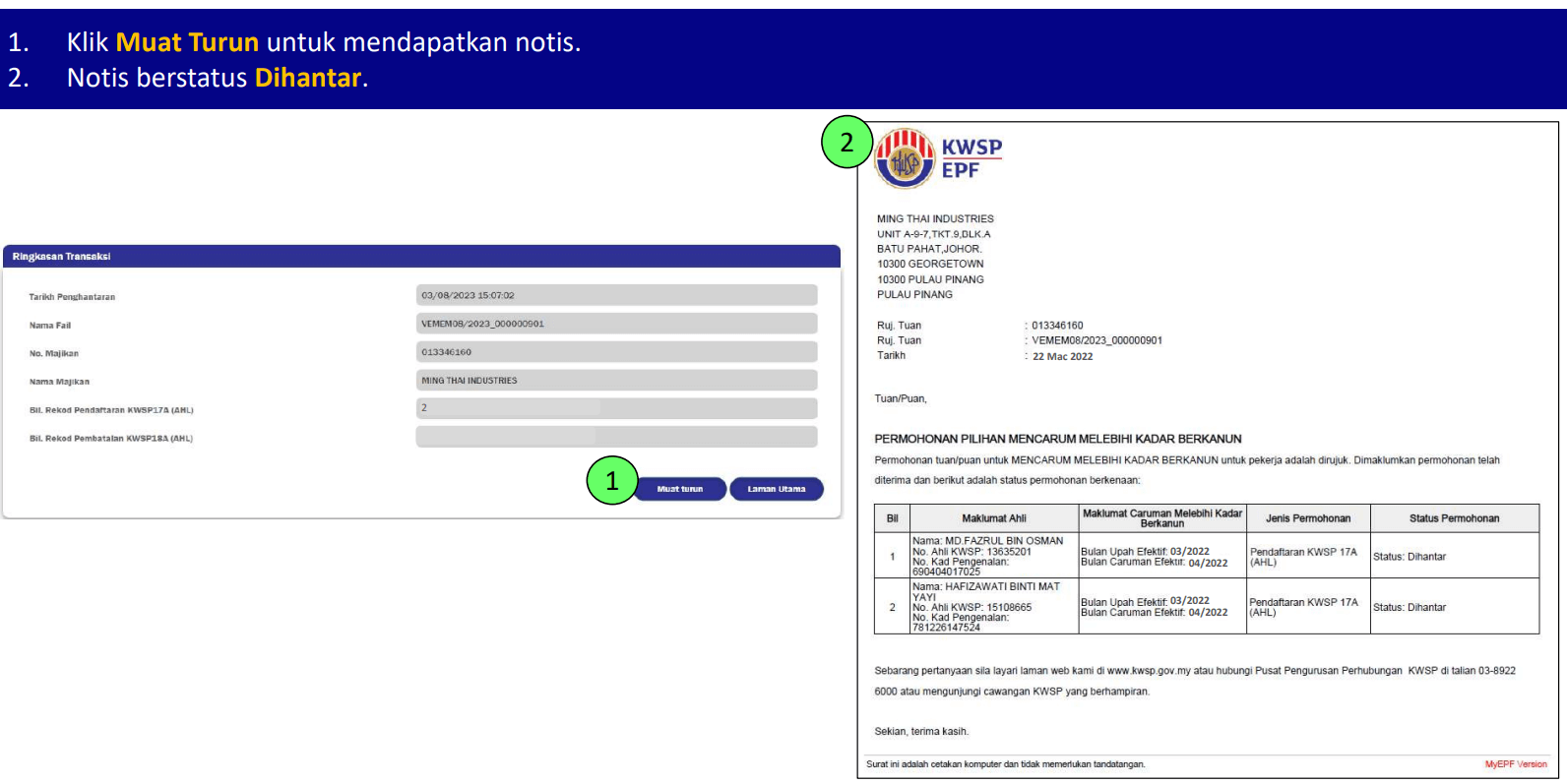

Once the form is submitted, click on Muat Turun to download the confirmation letter. The status should show as ‘Dihantar‘ (submitted) and you can proceed to increase the employee rate in the employee’s PayrollPanda profile before running payroll for the month entered as the effective wage month.

How to apply to KWSP to increase the EPF employer contribution rate

Employers are no longer required to fill in Form KWSP 17 (MAJ) and submit it to KWSP to increase their share of the contribution. They can now apply to increase the employer contribution for particular employees via their Employer iAkaun (Voluntary Excess tab). The process is the same as for employee contributions, except that Syer Majikan should be selected instead of Syer Pekerja under Jenis Voluntary Excess.

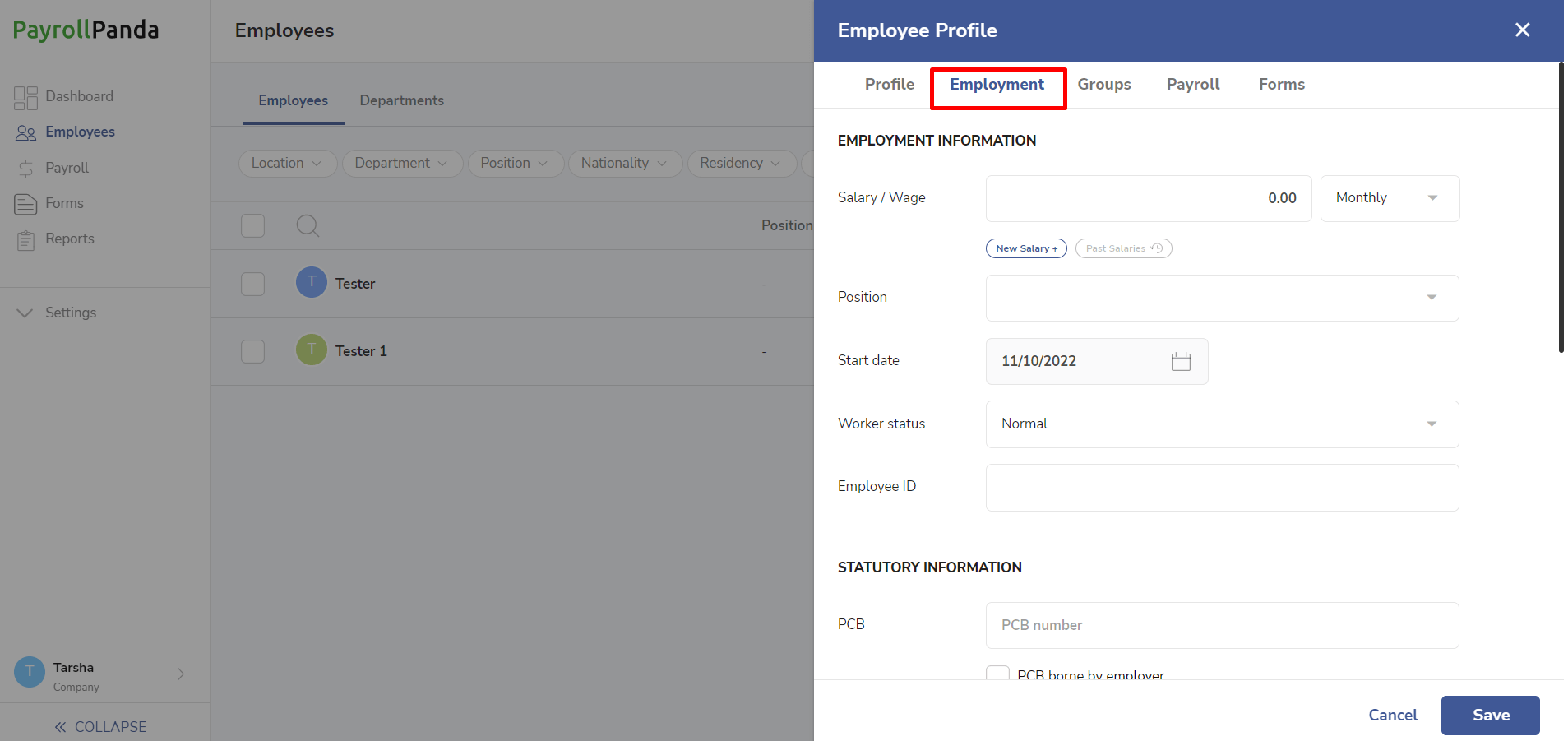

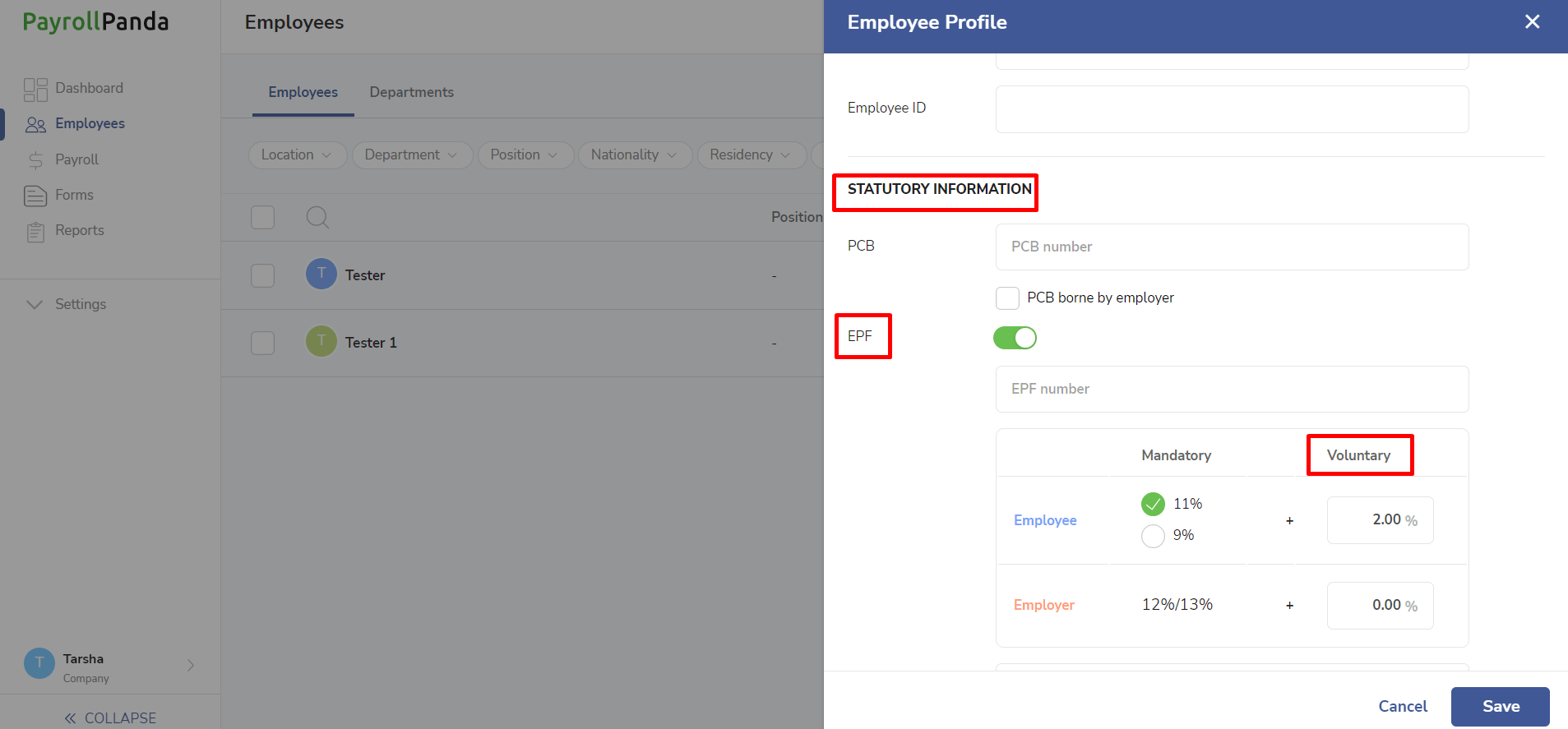

How to increase the contribution rate in PayrollPanda

Go to Employees > Select Employee > Employment > Statutory Information

Enter the additional rate for employee and/or employer contributions under the Voluntary fields.

So for example if the employee’s current contribution rate is 11% and you want to increase it to 13% you should enter 2% in the Voluntary field under Employee.

How to cancel the additional employee rate

To revert to the statutory rate for their share of the contribution, employees should submit Form KWSP18A (AHL) to their employer. The form must be kept by the employer for record purposes and does not need to be submitted to KWSP. The cancellation of the employee contribution rate is again done via the Employer iAkaun (Voluntary Excess tab).

The process is the same as when applying for the voluntary excess, except that employers should select Pembatalan under Jenis Permohonan and enter 0 as additional rate. Employers should also enter the effective wage month when the employee wants to revert to the statutory rate.

How to cancel the additional employer rate

The process to cancel the additional employer rate is the same as for employee contributions, except that Syer Majikan should be selected instead of Syer Pekerja under Jenis Voluntary Excess.

Please note that employers are no longer required to fill in Form KWSP 18 (MAJ) and submit it to KWSP to revert to the statutory rate.