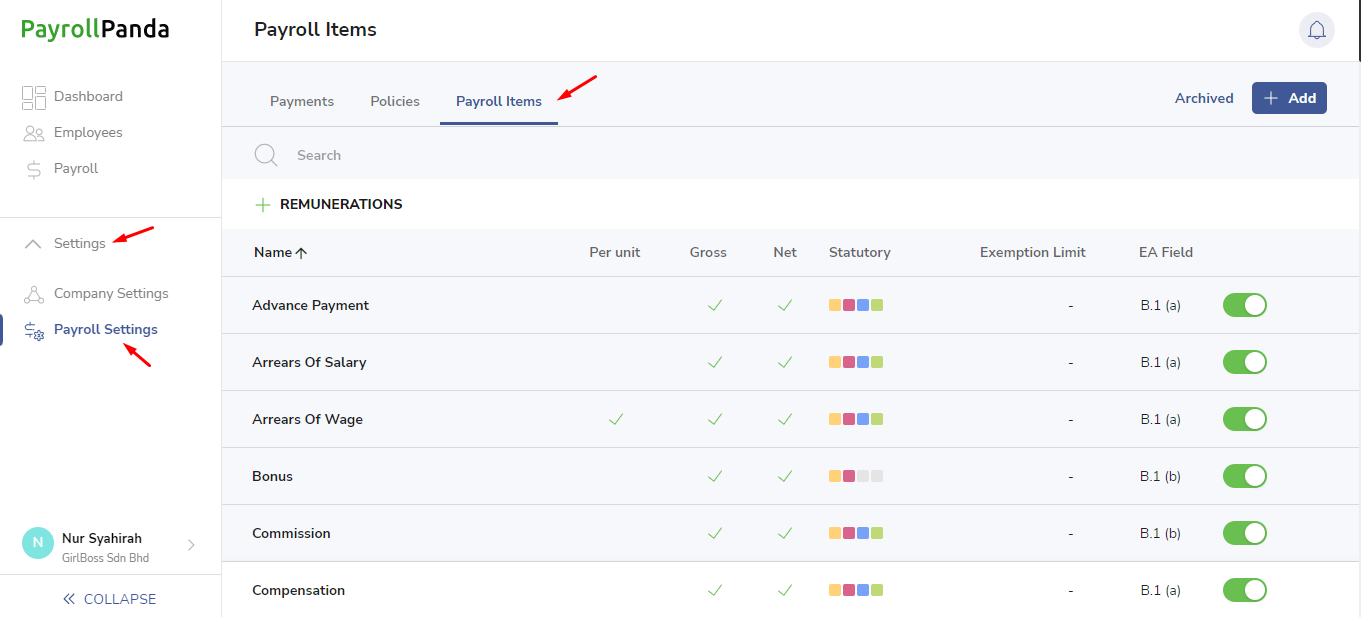

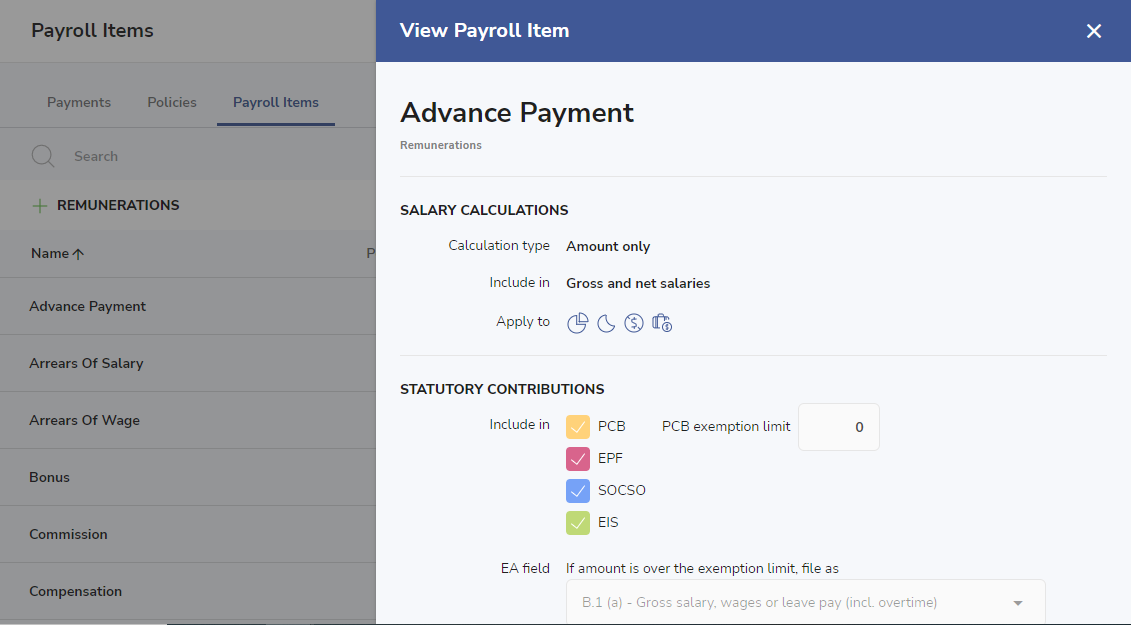

With over 80 preset payroll items, PayrollPanda has all types of additions and deductions ready to use for your payroll requirements. To check the settings of our preset payroll items, go to Settings > Payroll Settings > Payroll Items. You will be able to view whether the payroll item is included in the gross and/or net salary, which statutory contributions it is subject to, and which EA form field it will appear in. The statutory and EA field settings cannot be changed, but you are able to create custom payroll items if you prefer to have different settings.

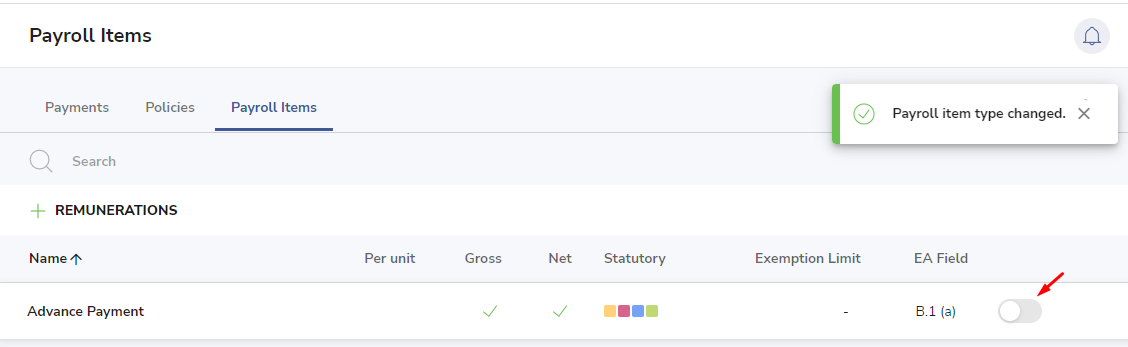

If you do not want the preset item to appear in the selection list when you are adding payroll items to an employee’s profile or in your payroll table, you can disable the payroll item as shown in the screenshot below.

You can click on each payroll item to view additional information, including whether by default the payroll item will be prorated when the employee joins or leaves the company, and whether it will be included in the wages subject to overtime, unpaid leave or leave pay calculations. You can change those default settings for a particular employee if required when you add the payroll item to the employee’s profile.

The statutory settings of our preset payroll items were set according to statutory regulations and verification by the statutory bodies. Please note that certain exemptions from statutory contributions may be dependent on specific conditions required for exemption. You can refer to our help articles to find out more details on exemption regulations for each statutory body, and we do recommend that you confirm the statutory settings of your salary payments directly with the statutory bodies.

To find out how to create custom payroll items which you can set according to your own requirements, please refer to How to create custom payroll items?