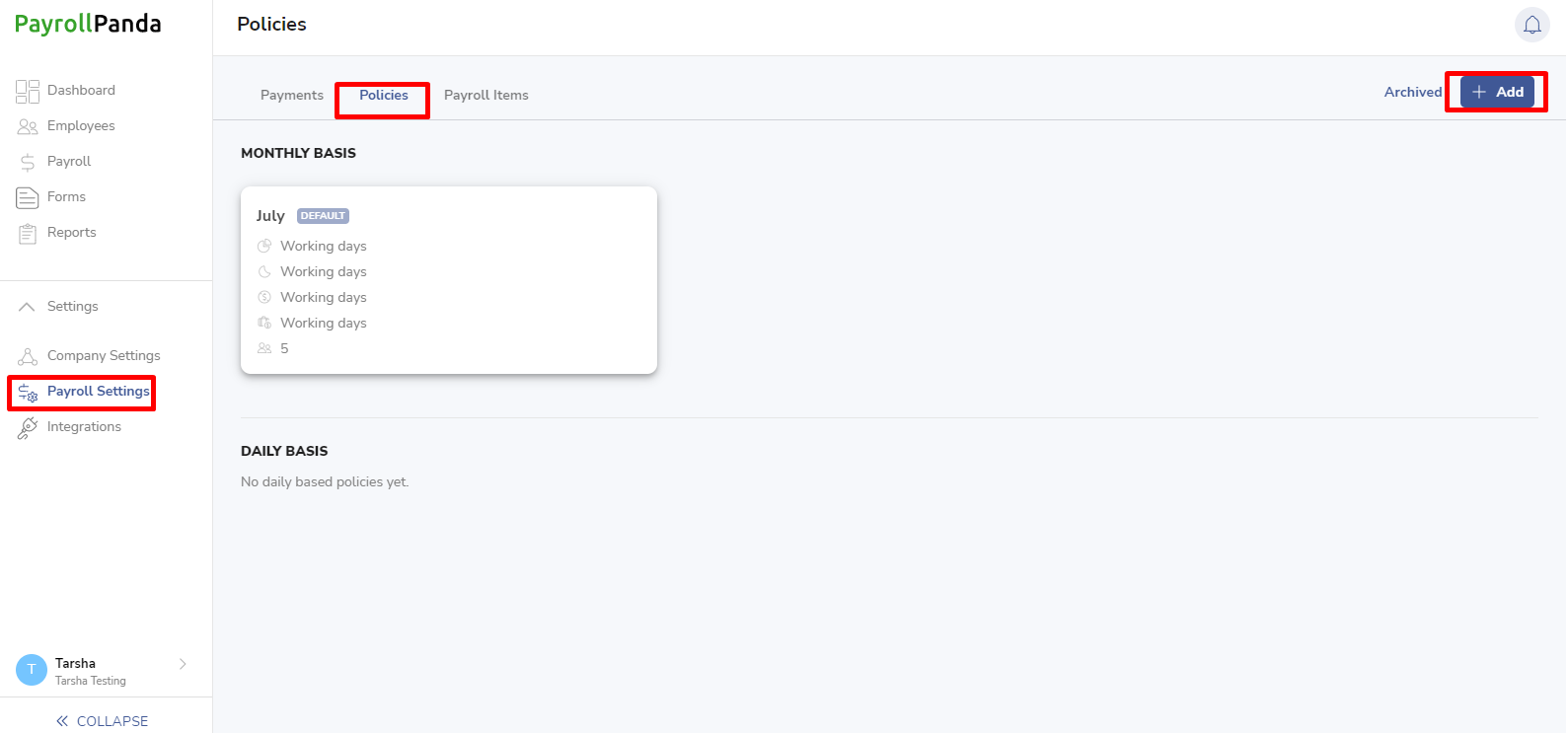

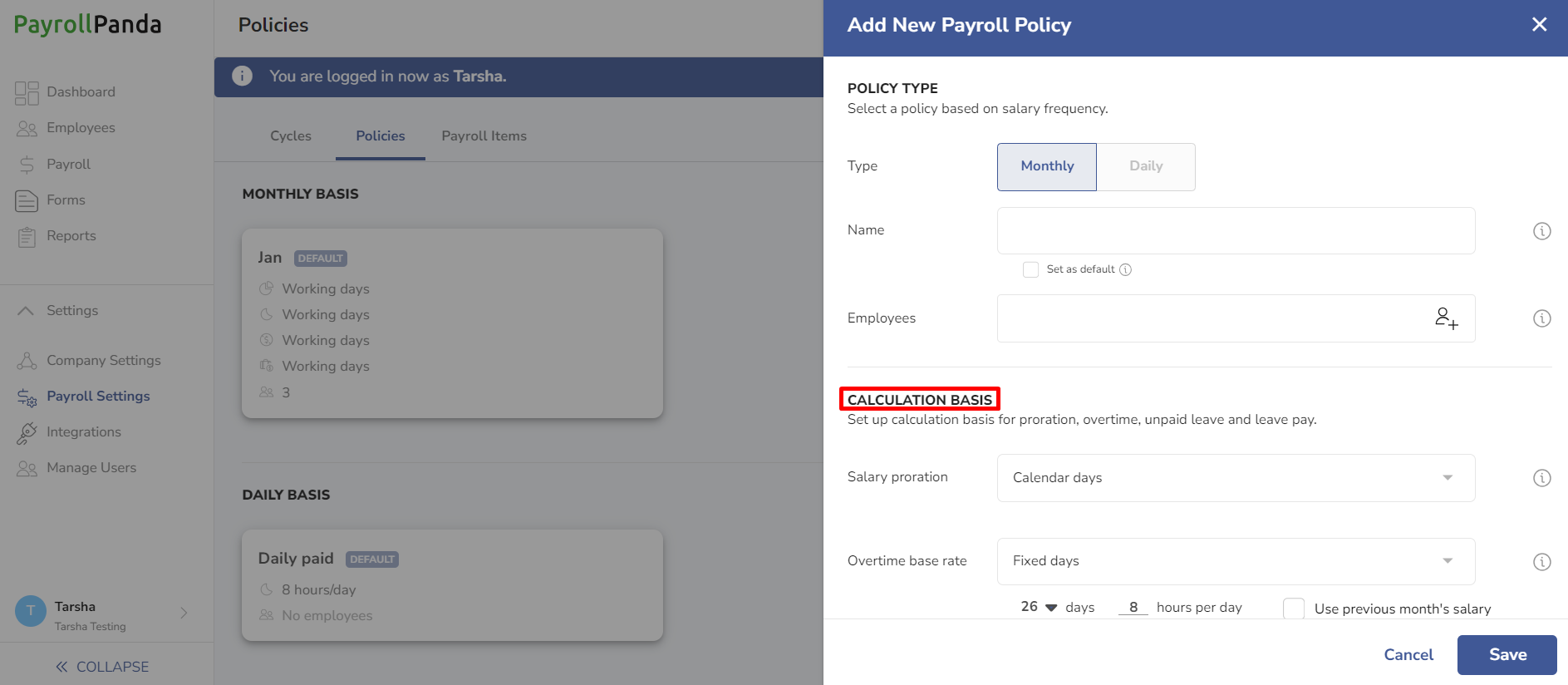

You can create different payroll policies for prorating, overtime, unpaid leave and leave pay calculations by going to Payroll Settings > Policies and clicking on +Add.

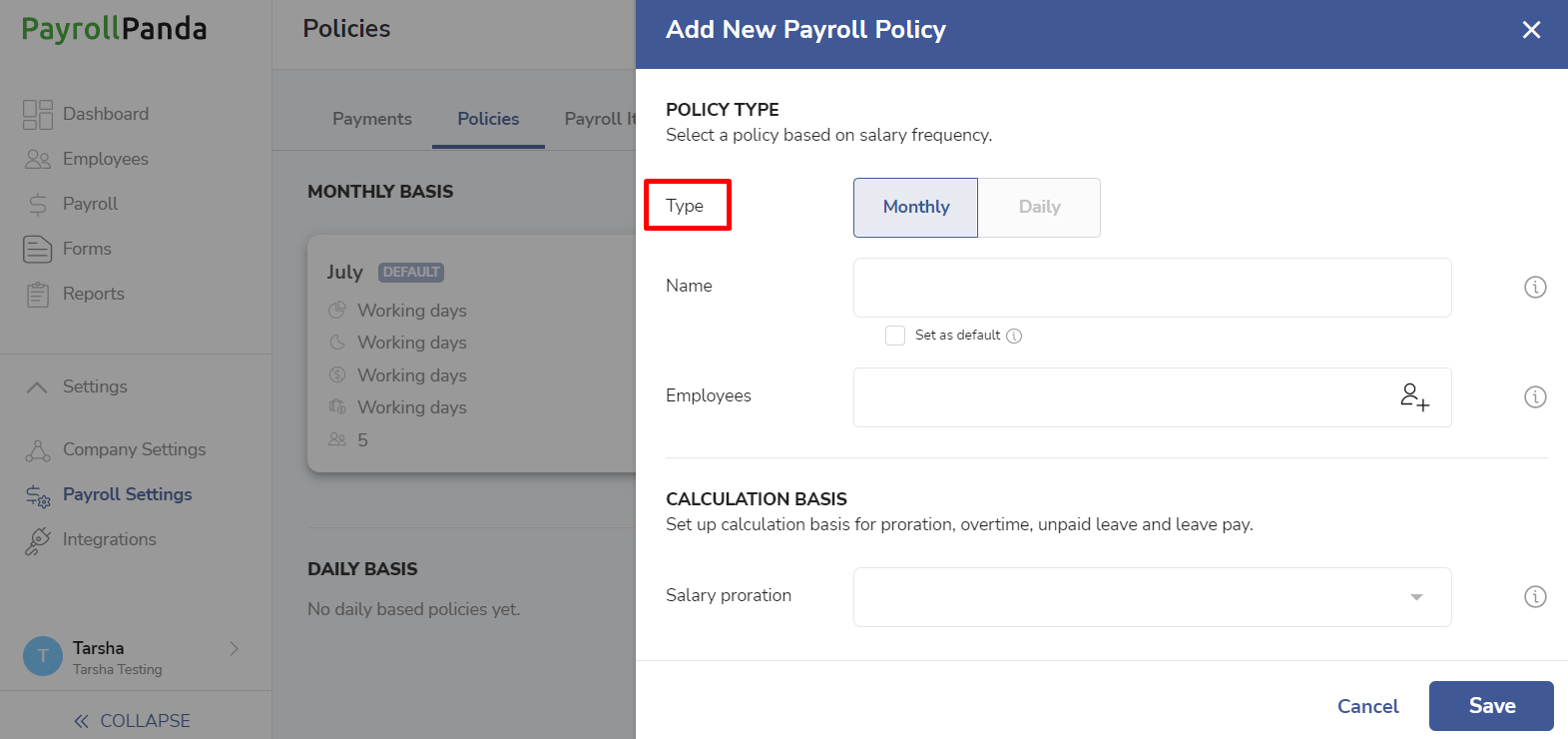

You should select whether the policy will apply to monthly or daily-paid employees.

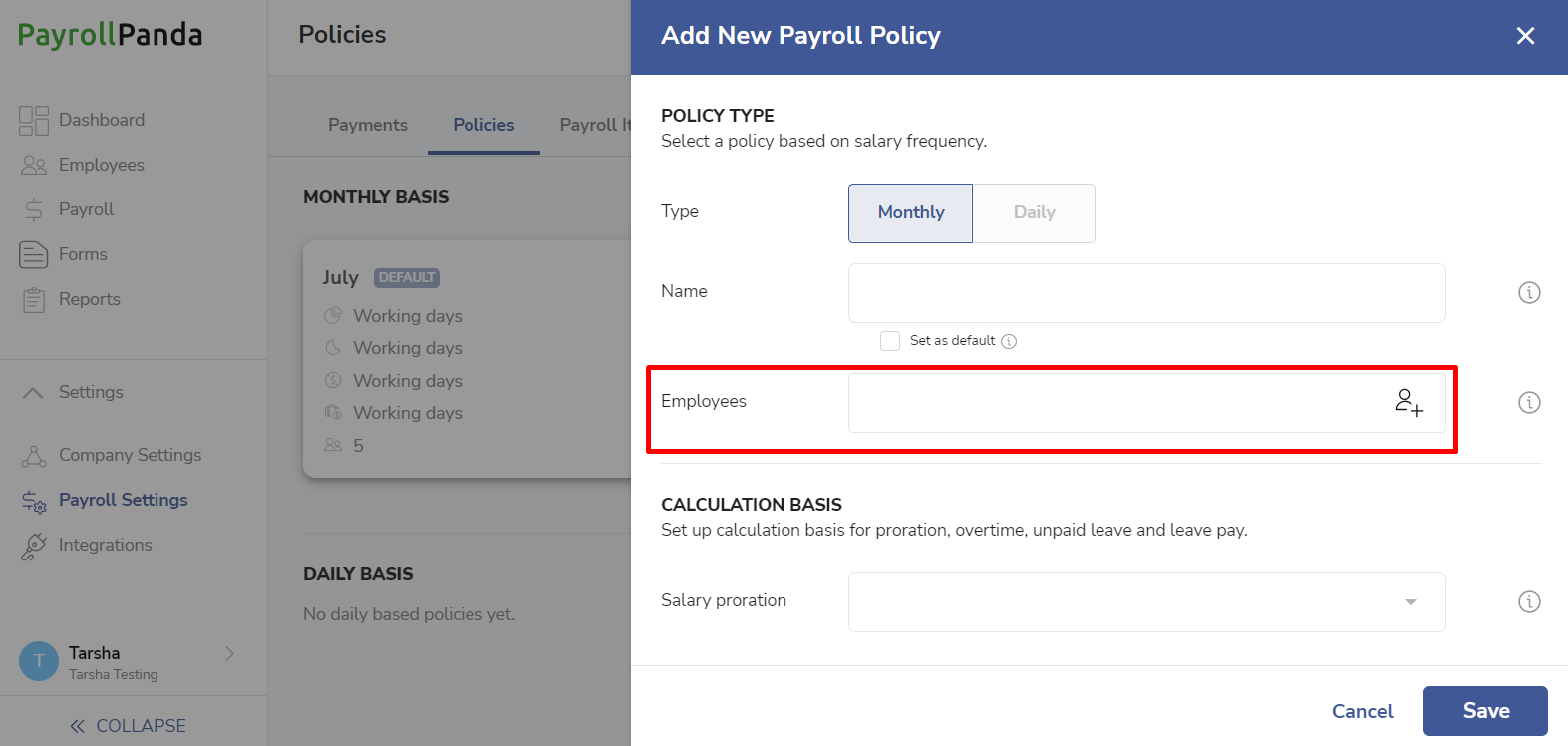

You should select the employees the payroll policy will apply to.

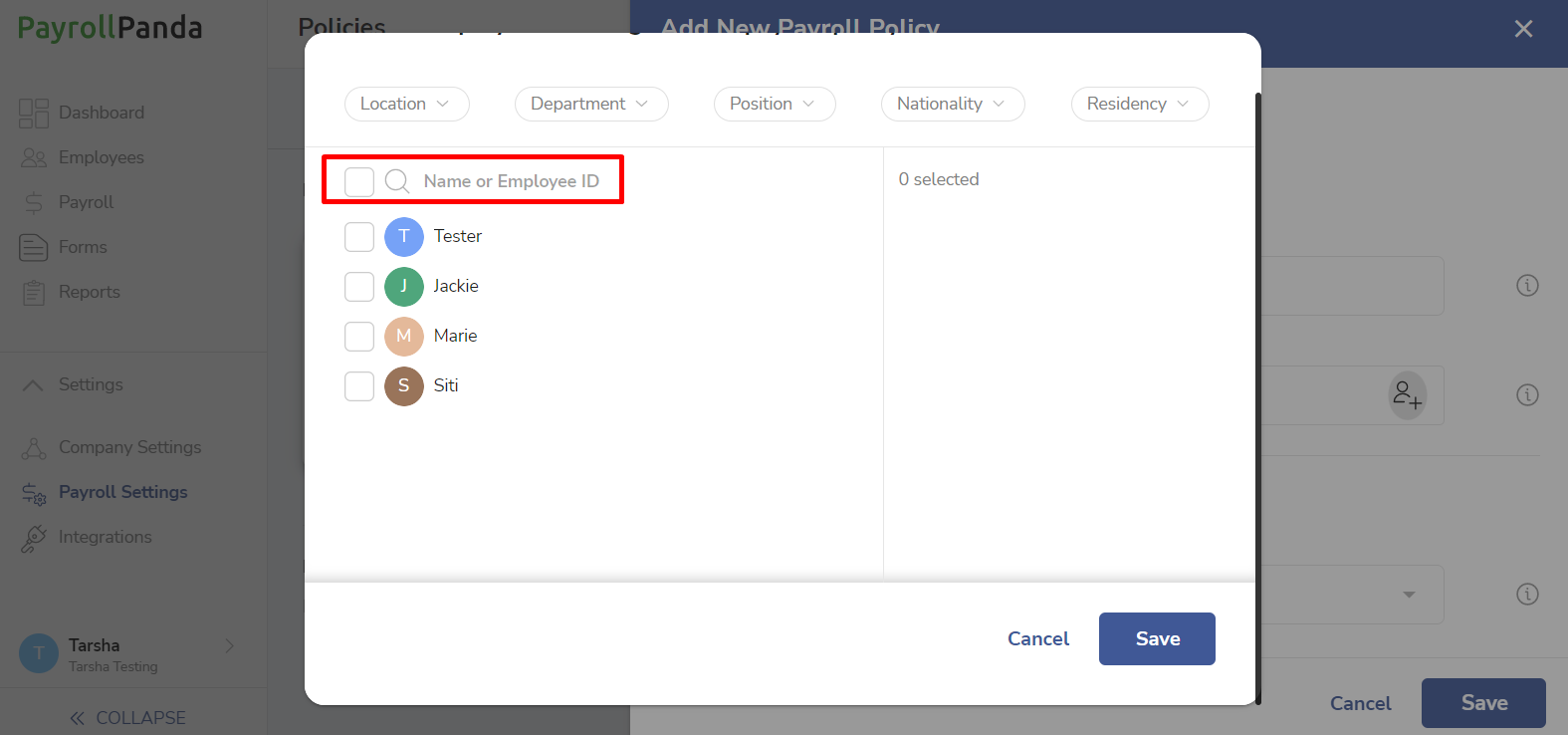

You can search for specific employees or use filters like location and department.

You should then select the calculation basis for prorating, overtime, unpaid leave and leave pay calculations.

Salary Proration

Salary proration applies to part-month calculations when an employee joins or leaves the company, or if the employee receives a salary increment during the month.

The formulae for each calculation basis option are:

- Fixed days: Salary * number of workdays since join date or until last day / number of fixed days.

- Working days: Salary * number of workdays since join date or until last day / total number of workdays in the month.

- Calendar days: Salary * number of days since join date or until last day / total number of days in the month. This is the basis specified under the Employment Act for all employees from 1 Jan 2023.

Note that the number of workdays is based on the workdays set in the Schedules tab, including any public holidays.

Overtime base rate

Select the basis for overtime hourly rate calculations for our automatic preset overtime items (Overtime x1, Overtime x1.5, Overtime x2, Overtime x3, Rest Day Pay and Public Holiday Pay) and any custom overtime items.

The formulae to calculate overtime hourly base rate based on each basis option are:

- Fixed days: Salary / number of fixed days / number of working hours per day.

- Working days: Salary / total number of workdays in the month / number of working hours per day.

- Calendar days: Salary / total number of days in the month / number of working hours per day.

Note that the number of workdays is based on the workdays set in the Schedules tab, including public holidays.

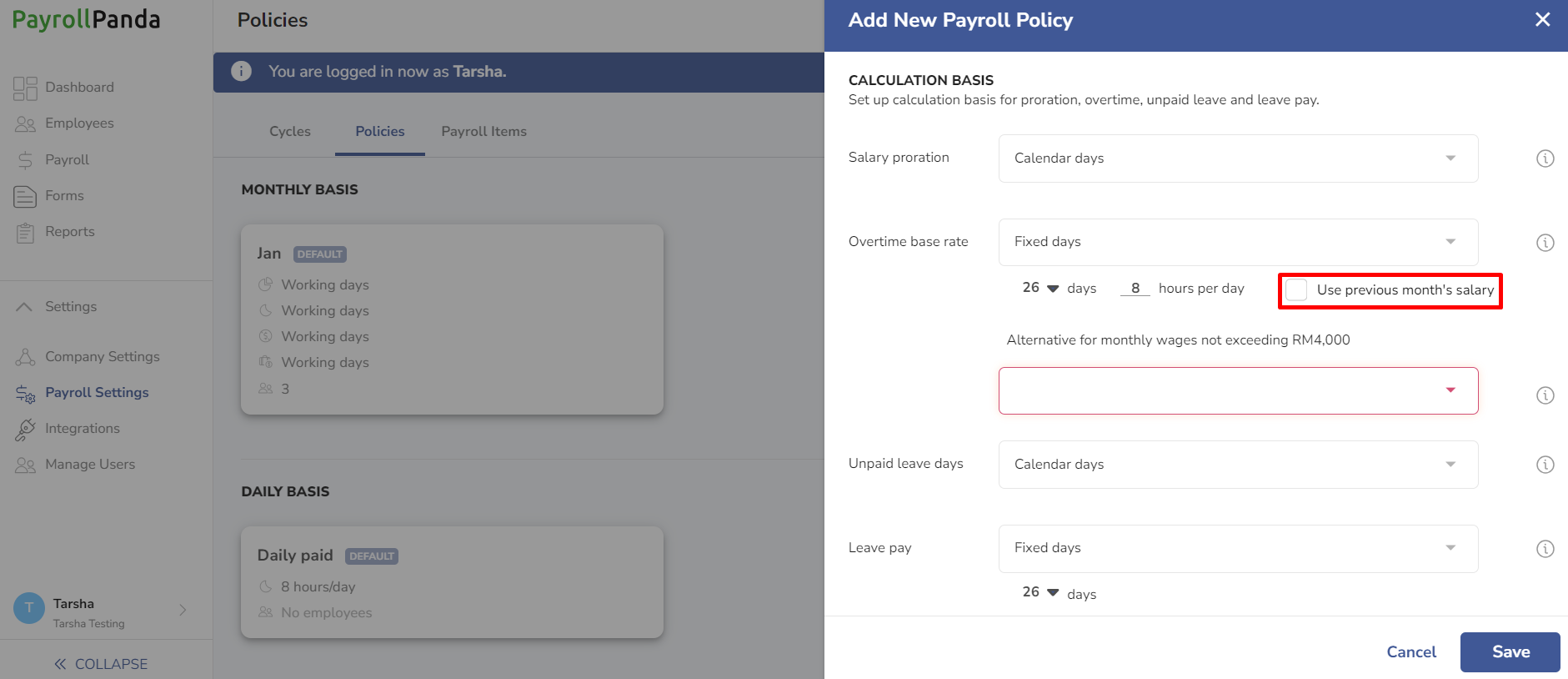

You can tick ‘Use previous month’s salary’ if you prefer to calculate the overtime hourly rate based on the previous month’s salary instead of the current month’s salary.

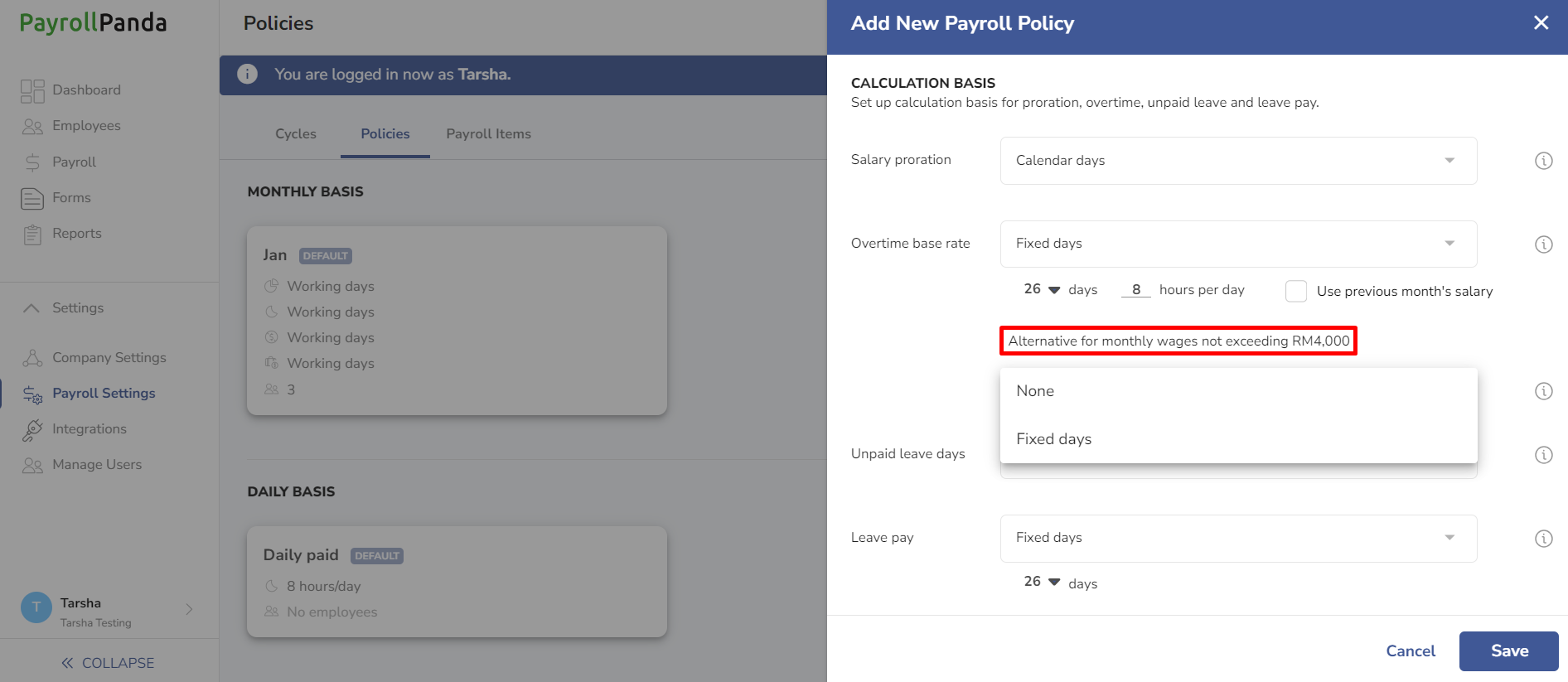

The minimum daily rate of pay for overtime payments under the Employment Act is based on 26 days (from 1 Jan 2023, this applies to employees whose wages do not exceed RM4,000), although the employer can also opt for any basis more favourable to the employee (like 22 days for employees working 5 days a week). You are able to select a different basis for any employees entitled to overtime under the Employment Act.

Unpaid leave days

Select the basis to calculate the daily rate for unpaid leave calculations.

The formulae to calculate the daily rate based on each basis option are:

- Fixed days: Salary / number of fixed days.

- Working days: Salary / total number of workdays in the month.

- Calendar days: Salary / total number of days in the month. This is the basis specified under the Employment Act for all employees from 1 Jan 2023.

Note that the number of workdays is based on the workdays set in the Schedules tab, including public holidays.

Leave pay

Select the basis to calculate the daily rate for leave pay calculations.

The formulae to calculate the daily rate based on each basis option are:

- Fixed days: Salary / number of fixed days.

- Working days: Salary / total number of workdays in the month.

- Calendar days: Salary/total number of days in the month.

Note that the number of workdays is based on the workdays set in the Schedules tab, including public holidays.

The minimum daily rate for unutilised leave pay under the Employment Act for employees leaving the company is based on 26 days, although the employer can also opt for any basis more favourable to the employee (like 22 days for employees working 5 days a week).