The HRDF levy is a levy payment collected for the purpose of employee training and skills upgrading. Employers with at least 10 full-time Malaysian employees (whether permanent, contract or temporary) are obligated to register, while employees with 5 to 9 full-time Malaysian employees have the option to register.

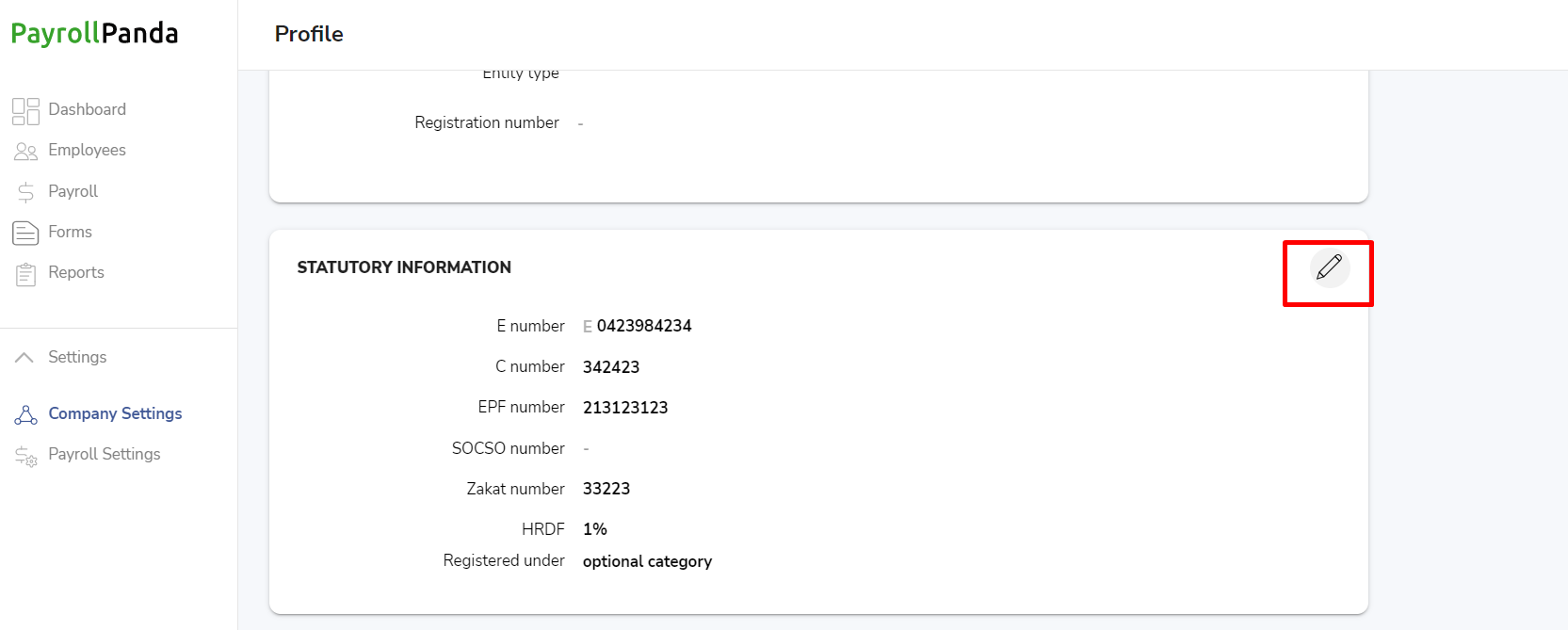

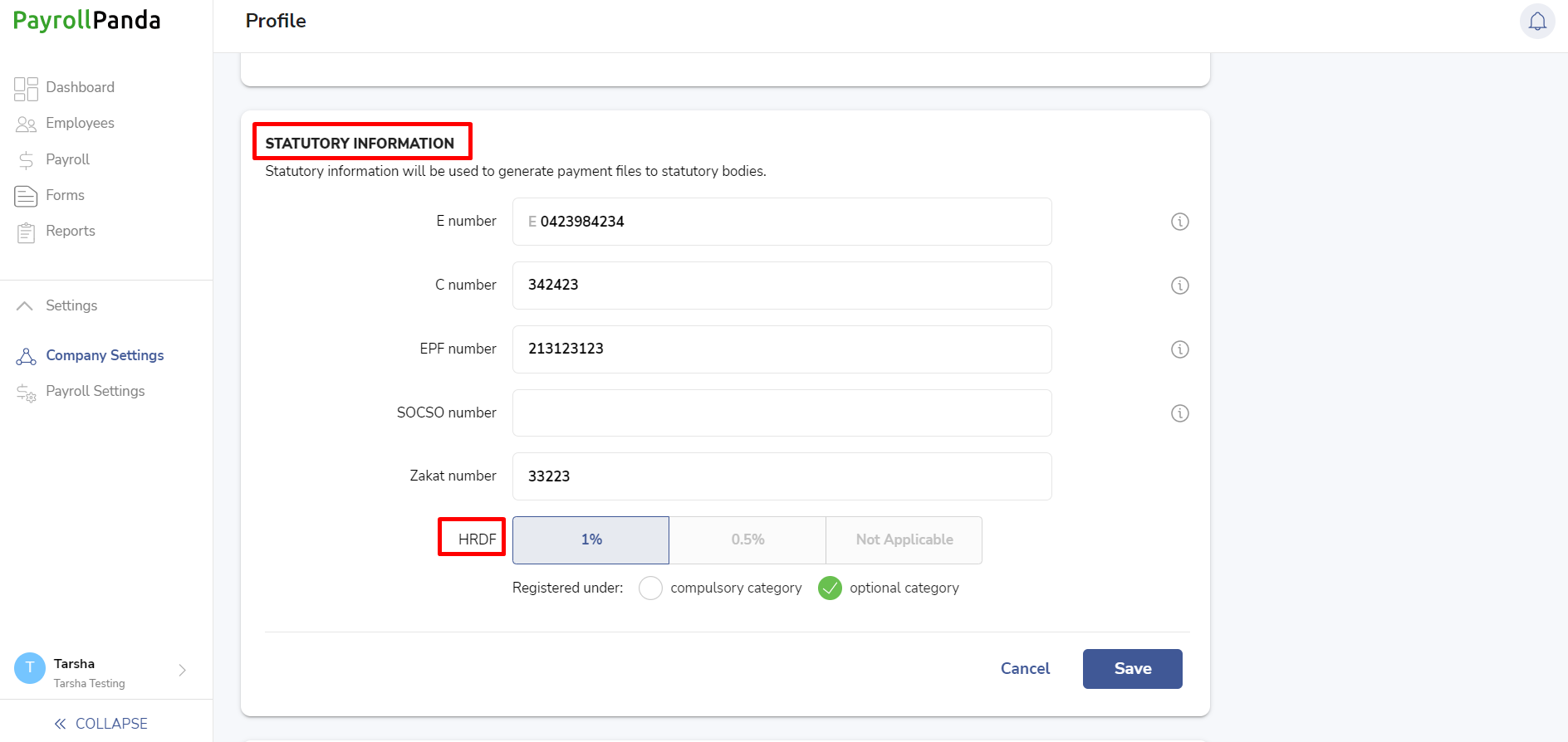

To enable the HRDF levy, go to Settings > Company Settings > Statutory Information and click on the Pencil icon. You can then select 0.5% or 1% rate. If you select 1% rate you should select whether you originally registered with HRDCorp under the optional or compulsory category.

Employers with 5 to 9 full-time Malaysian employees register under the optional category and contribute at a rate of 0.5%. Please note that under HRDF regulations, if you registered under the optional category, once you reach 10 Malaysian employees you must continue to contribute at 1% for the whole year even if your headcount falls again to fewer than 10 employees during the year.

Employers with 10 or more full-time Malaysian employees register under the compulsory category and contribute at 1%, even if their headcount falls to below 10 employees. They will have to deregister in order to stop paying the levy.

The wages of part-time employees, interns and non-Malaysian employees are not included in the levy calculation, as only full-time Malaysian employees are subject to HRDF.

The HRDF contribution is calculated based on basic salary plus any fixed allowances, except travel allowances. In PayrollPanda, any allowances added as recurring payroll items in the employee’s profile will be added to the salary subject to HRDF, except:

- Travel/Petrol Allowance (Official Duties)

- Travel/Petrol Allowance (Records Kept For 7 Years)

- Parking Allowance

- Internship Allowance

If a custom payroll item is created under the Allowances category and added to the employee’s profile as a recurring payroll item, it will also be included in the calculation. If you have monthly recurring allowances which are not fixed and you do not want them included in the HRDF calculation, you should create a custom payroll item under the Other Perquisites category instead of the Allowances category. For more information regarding monthly recurring payroll items, see this help article.

Please note that the following payroll items will affect the HRDF calculation:

- Additions: Leave Pay, Advance Payment, Arrears of Salary, Arrears of Wages and Additional Salary.

- Deductions: Unpaid Leave,.Advance (Payment Made via payroll) and Salary Adjustment.

If you prefer to add your own HRDF amount for each employee, you can use our preset payroll deduction Employer HRDF Levy (Custom).

Example of HRDF levy calculation:

If you are contributing 1% and your employee earns RM3,000 plus a fixed allowance of RM250, the calculation for the HRDF levy is as follows:

(RM3,000 + RM250) * 1% = RM32.50