CP38 deductions are only necessary when LHDN issues a notice to the employer directing them to make additional tax deductions in monthly instalments from the employee’s salary to settle income tax arrears from previous years.

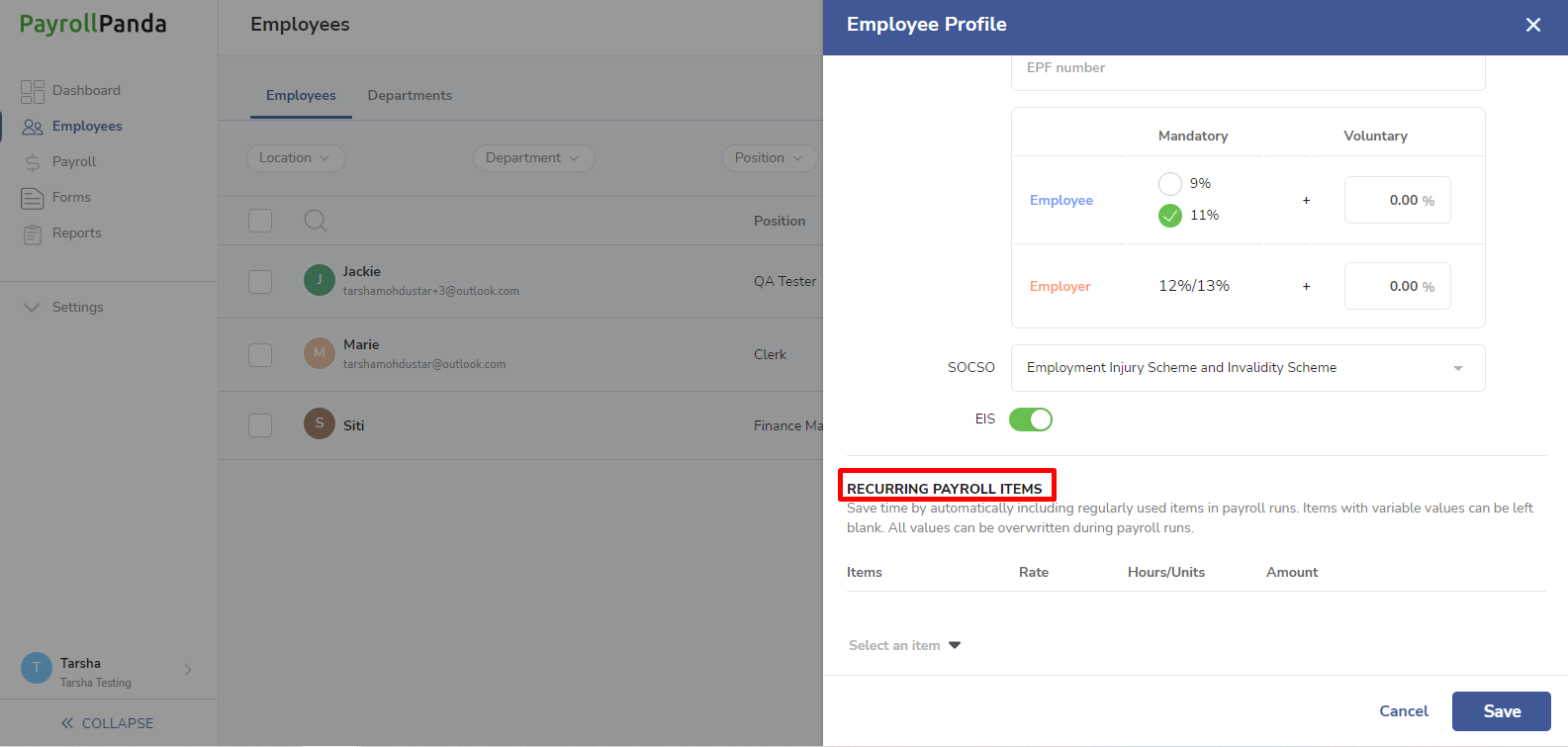

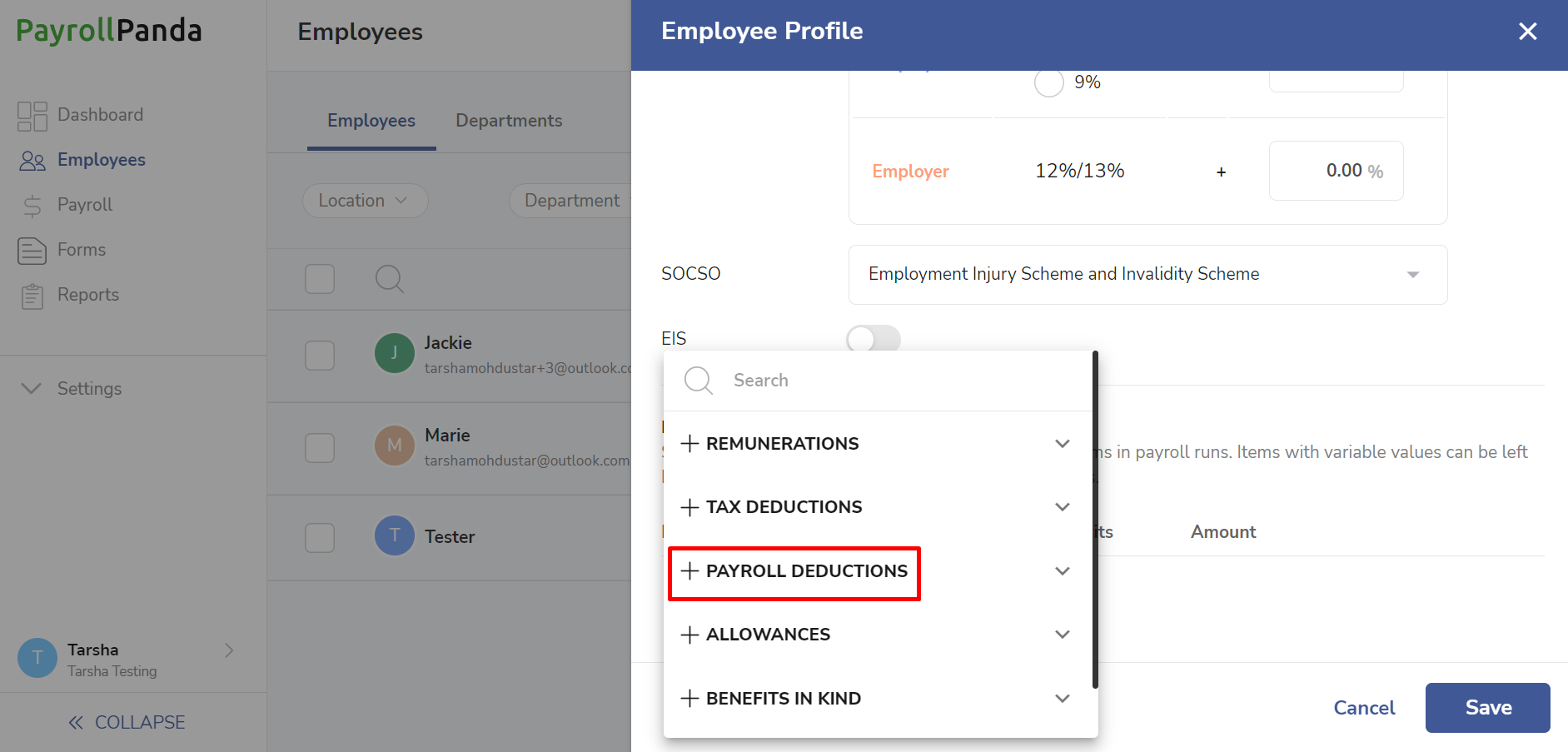

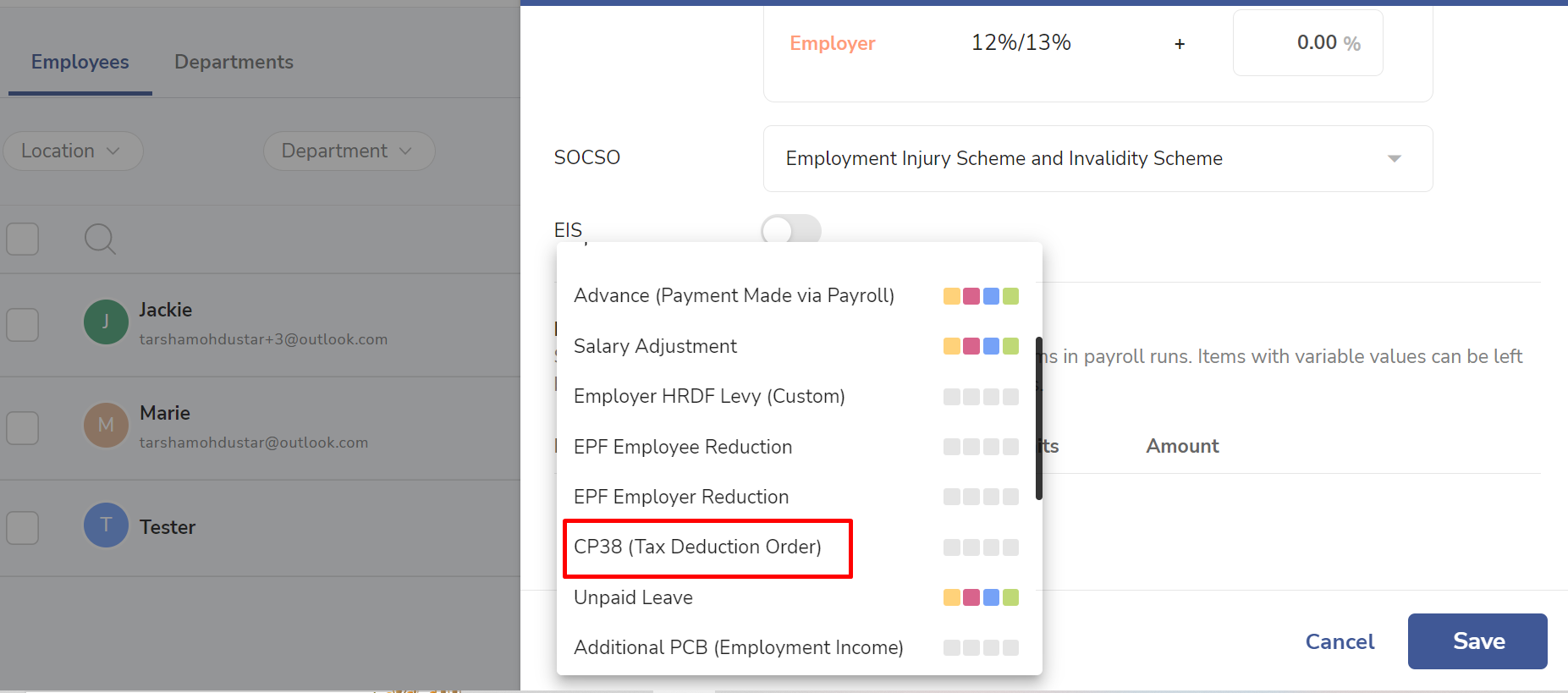

Since the deduction will usually have to be made for a few months, you can add our preset deduction item CP38 (Tax Deduction Order) as a recurring payroll item in the Employment tab of the employee’s profile. The deduction can be found under the Payroll Deductions category.

The CP38 amount will not be added to the PCB total but it will appear in the PCB statutory and bank files for submission and payment to LHDN.