SOCSO Contribution Rates

What Is SOCSO in Malaysia?

SOCSO, or the Social Security Organisation (PERKESO), is a government body that provides social security protection for employees in Malaysia. Under the Employees’ Social Security Act 1969, it offers benefits such as medical coverage, disability benefits, and compensation for workplace injuries or occupational diseases.

Who Is Required to Contribute to SOCSO?

SOCSO contributions are mandatory for all private-sector employees in Malaysia. This includes full-time, part-time, and contract employees earning up to RM6,000 per month.

Both employers and employees contribute, with employers responsible for deducting the employee’s share and submitting the total contributions to SOCSO. Certain groups, such as public sector employees with pension schemes and domestic workers, are generally exempt.

How Are SOCSO Contributions Calculated?

SOCSO contributions consist of two schemes:

- Employment Injury Scheme: Covers workplace accidents and occupational diseases.

- Invalidity Pension Scheme: Provides long-term benefits for invalidity or retirement.

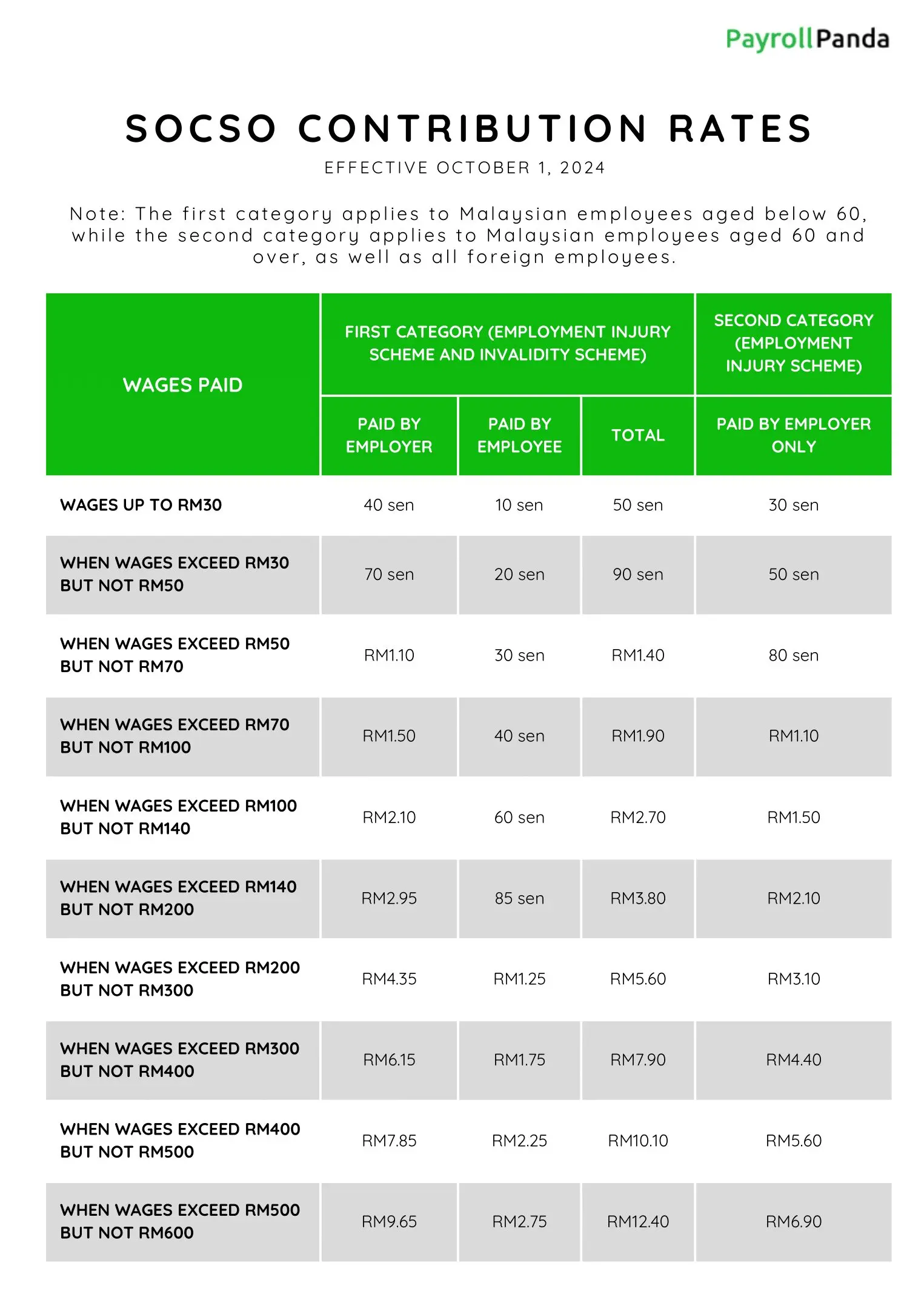

Contribution rates are based on monthly wages, with both employer and employee contributions calculated according to SOCSO’s prescribed tables.

What Benefits Do Employees Receive From SOCSO?

Employees covered by SOCSO can claim:

- Medical and rehabilitation benefits for work-related injuries or illnesses

- Temporary or permanent disability benefits

- Invalidity pensions

- Dependents’ benefits in the event of work-related death

These benefits help provide financial security and workplace protection for employees and their families.

Our comprehensive poster for SOCSO rates in Malaysia provides a detailed overview of the different contribution rates set according to wage categories under the 2 schemes i.e. employment injury and invalidity scheme and the employment injury scheme. Download below!

Payroll Panda’s poster for SOCSO rates in Malaysia