A payroll calculator is a tool used to estimate an employee’s net pay after accounting for various deductions and taxes. It simplifies manual calculations and provides a quick estimate of employee take-home pay.

A payroll calculator typically requires users to input employee information such as salary, deductions, and tax details. Based on this input, the calculator automatically calculates gross pay, deductions for taxes and other withholdings.

Yes! PayrollPanda is regularly updated to ensure that it adheres to the latest changes in tax laws, labour regulations and statutory requirements in Malaysia, helping businesses stay up-to-date with changes in legislation and avoid penalties for non-compliance.

PayrollPanda offers a comprehensive solution designed to streamline and optimise your entire payroll process:

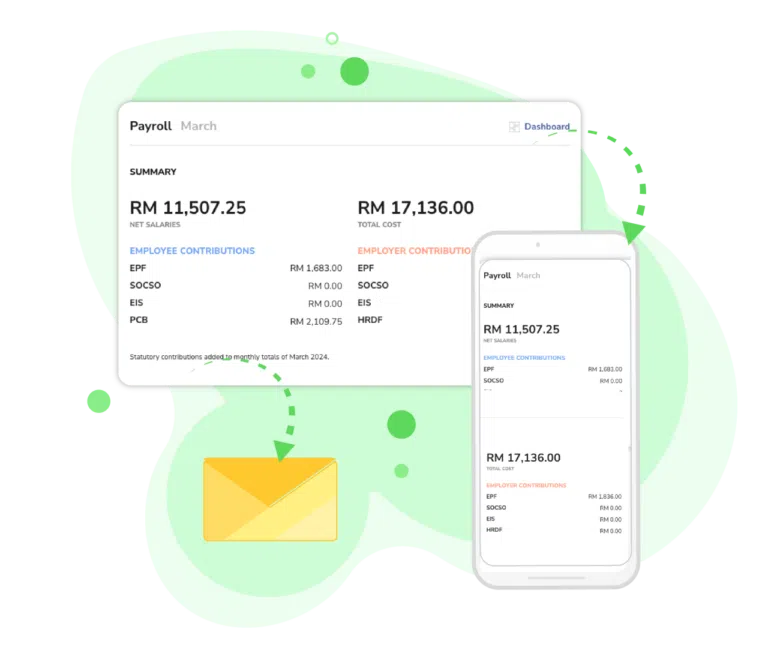

- Full Payroll Processing – PayrollPanda automates the entire payroll process, from calculating employee wages and deductions to generating payslips and managing statutory contributions.

- Compliance Management – Stay up-to-date with the latest contribution rates and legal requirements for calculating taxes, EPF, SOCSO and other statutory contributions.

- Handles Complexities – Unlike calculators limited to basic pay structures, PayrollPanda can handle intricate scenarios with various deductions, allowances, bonuses, and overtime calculations.

- Deeper Analysis – PayrollPanda provides a comprehensive view of your payroll data. Go beyond just net pay estimates and gain insights into employee earnings reports, departmental cost analysis, leave and absence reports, and tax & contribution reports.

- Seamless Integrations – PayrollPanda integrates seamlessly with other software systems commonly used by businesses, such as accounting software, HR management systems, and time tracking tools.

Yes! PayrollPanda is a Malaysian payroll software that is completely free forever, allowing businesses to explore all of PayrollPanda’s features, such as payroll calculations, tax calculations, statutory contributions, and reporting at no cost.