With the QuickBooks integration, you can sync your payroll data into your accounting books.

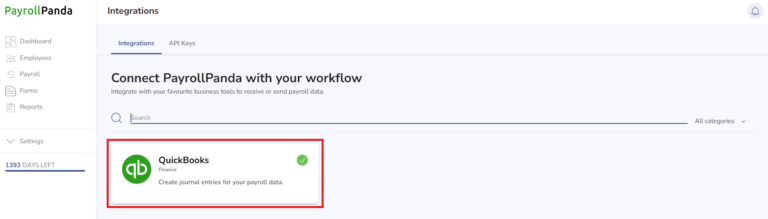

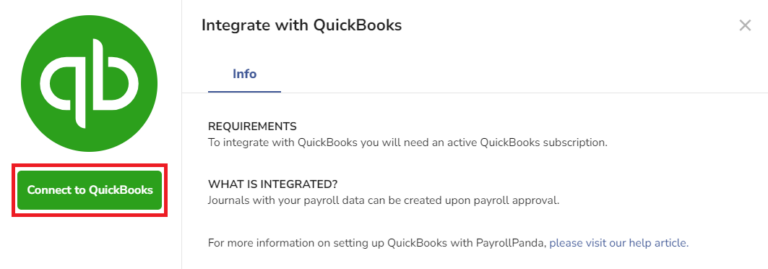

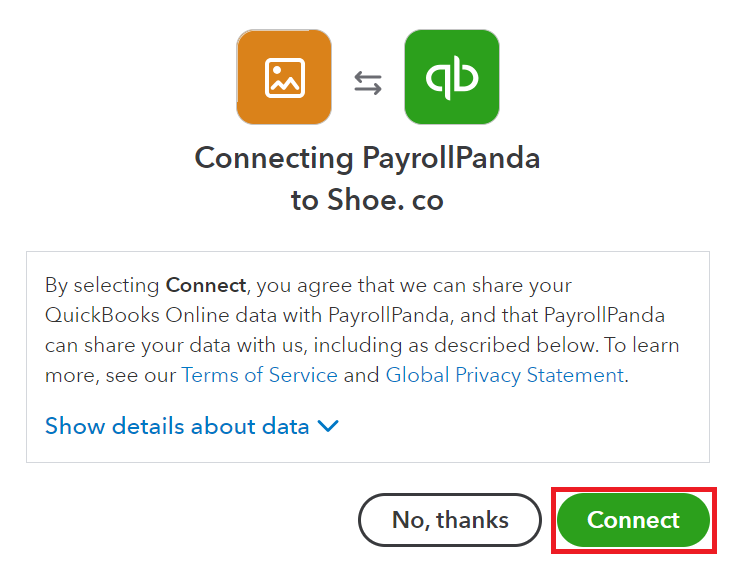

1. Connect your QuickBooks account

Connect your account by clicking on Settings > Integrations > QuickBooks > Connect to QuickBooks. Log in to QuickBooks and click on Connect.

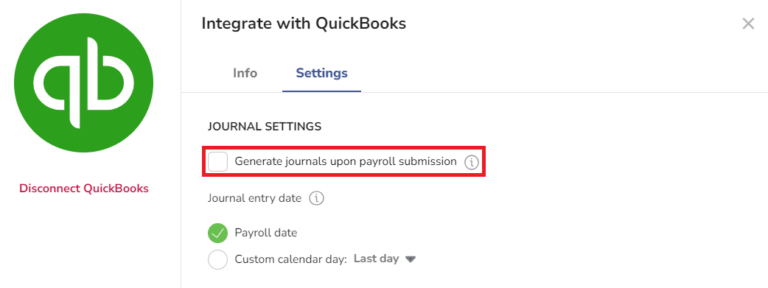

2. Select your journal settings

You can choose if you want to generate your QuickBooks journal entry automatically when you approve your payroll. You can select the journal entry date as the payroll approval date or a custom date.

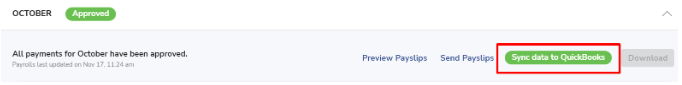

If you do not tick the option to sync automatically on payroll submission, you will be able to sync individual payrolls by clicking on Run Payroll > select payroll month > Sync Data to QuickBooks.

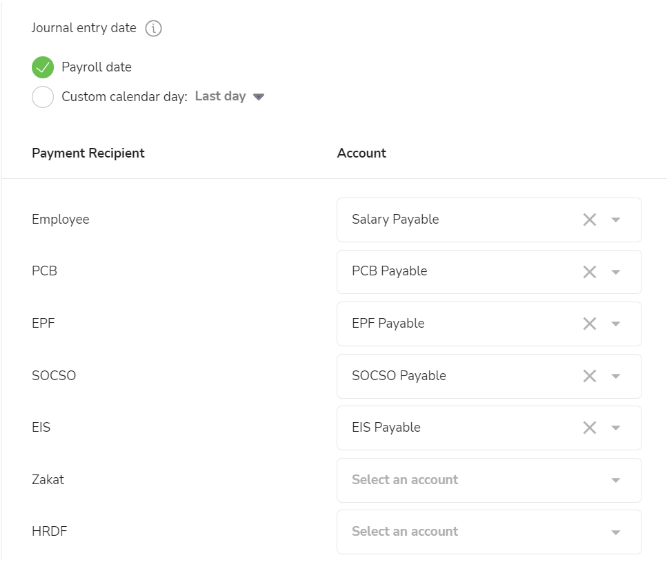

3. Map your payment recipients to your QuickBooks creditor accounts

Select a QuickBooks creditor account for each salary and statutory payment recipient. For example, Employee can be mapped to Salary Payable while EPF can be mapped to PCB Payable or to LHDN depending on the names of your accounts in QuickBooks.

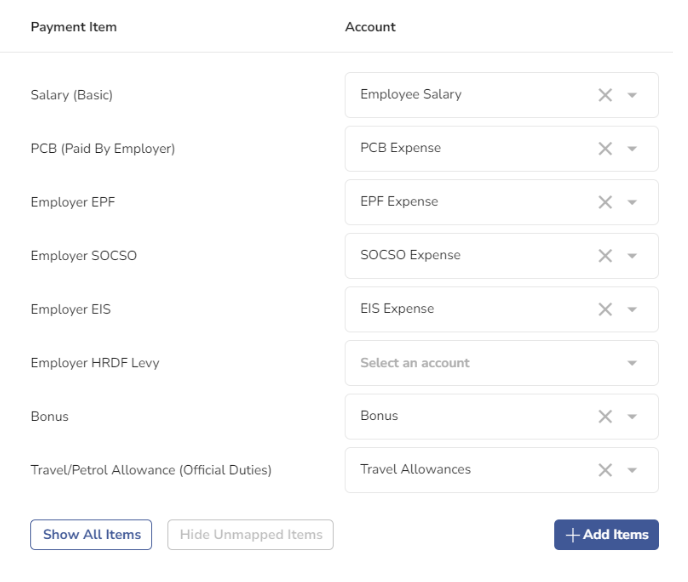

4. Map your payment items to your QuickBooks expense accounts

Map your payroll items to the suitable expense accounts. Basic salary and any additional payroll items or deductions should be mapped. You can choose to add additional payroll items individually or you can show all payroll items. Only employer contributions need to be mapped since employee contributions are already included in the gross salary amounts (basic salary + any additional payroll items).