Navigating the PCB system is crucial for Malaysian employers to ensure compliance with tax laws and accurate payroll management. Large penalties may be incurred if PCB is underpaid, while overdeducting PCB could result in complaints from your employees.

This comprehensive PCB guide will walk you through the essentials of PCB, including how to calculate deductions, meet submission deadlines, and adhere to compliance requirements.

This article covers:

- What is PCB?

- What types of earnings are subject to PCB?

- How can employers determine PCB deductions?

- How is PCB calculated?

- How do I register as an employer with LHDN?

- How can I submit and pay PCB?

- How to notify LHDN when employees join or leave my company?

- What are the employers’ responsibilities imposed by LHDN?

- What are the penalties for non-compliance?

What is PCB?

PCB stands for Potongan Cukai Bulanan in Malay, which translates to Monthly Tax Deductions (MTD). It is a series of monthly deductions that go towards payment of your annual tax in relation to your employment income. PCB is deducted by the employer from the employee’s monthly salary and remitted to the Inland Revenue Board of Malaysia (LHDN) each payroll month. Its purpose is to ensure that individuals pay their taxes in monthly installments throughout the year, rather than in a lump sum at the end of the year, thereby making tax payments more manageable for employees and maximising tax revenues for LHDN.

What types of earnings are subject to PCB?

PCB will be payable if the employee’s chargeable income reaches the PCB threshold.

Most types of employment earnings are taxable, including basic salary, overtime, commission and bonuses, as well as directors’ fees and service charges paid to employees.

Certain allowances and benefits-in-kind are tax-exempt (either fully or up to a certain amount annually), so the exempt amounts should not be included in the PCB calculation.

The monthly value of taxable benefits-in-kind like a company car or living accommodation should be added to the monthly taxable income for PCB calculation purposes, even if no actual payment is made to the employee for those benefits.

How can employers determine PCB deductions?

Employers have 3 options:

- PCB table (jadual PCB): this is a concession for employers who do not use a payroll software. The table shows the PCB payable for each salary range, taking into account any spouse and child tax deductions claimed. It assumes that the employee receives the same salary throughout the year and so it is not as accurate as the other methods. The PCB table is no longer published since 2019 but it can still be used electronically via the e-CP39 portal.

- LHDN calculator or e-PCB portal: The LHDN calculator uses a formula which takes into account actual income and deduction data for previous months of the year to arrive at the annual chargeable income and remaining annual tax payable in order to determine the PCB amount for a particular month. The same formula is also used in e-PCB portal calculations. Employers can use the e-PCB portal to calculate and submit their monthly PCB.

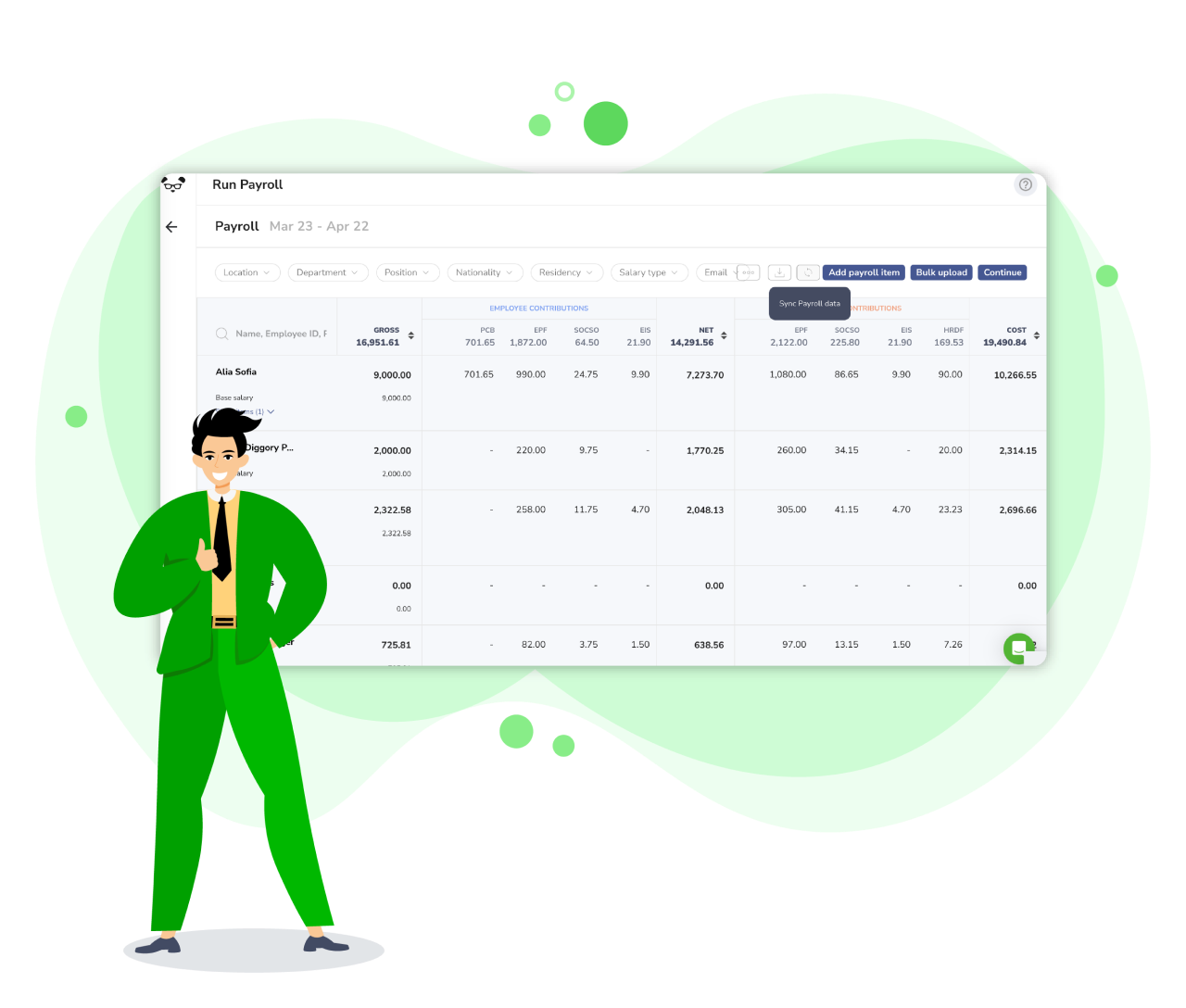

- Payroll software: Payroll softwares like PayrollPanda use the same formula as the LHDN calculator to calculate PCB automatically based on the personal and remuneration data entered for each employee.

How is PCB calculated?

While the formula is complicated it can be simplified as follows:

- Annual taxable income = previous months taxable income + (recurring current month taxable income + non-recurring current month taxable income) + recurring current month taxable income * number of months remaining in the year

- Annual taxable income – tax deductions = annual chargeable income

- The annual tax is then calculated based on the annual chargeable income (tax rates)

- PCB = (annual tax – PCB already paid) / number of months remaining in the year.

How do I register as an employer with LHDN?

Businesses with employees need to register an employer tax file with LHDN and obtain an E number in order to pay PCB, as well as submit their annual employer tax return (E form). Employers can complete the process online through e-Daftar via the MyTax portal.

You can expect to receive your E number within 5 working days.

How can I submit and pay PCB?

PCB can be submitted using one of the LHDN portals below:

- e-CP39: for manual submission of monthly tax deductions and for one-time submissions, using the PCB table or PCB calculator.

- e-PCB: for manual submission of monthly tax deductions using the PCB calculator. Data entry is required but previous submissions and accumulated income and deduction amounts are recorded.

- e-Data PCB: for submission of monthly tax deductions via file upload. No data entry is required as employers can simply upload the PCB file generated by payroll software like PayrollPanda.

Payment can be made as follows:

1. Online via the above portals through FPX if you have an account with one of these banks:

- AmBank

- Bank Islam

- CIMB Bank

- Hong Leong Bank

- Maybank2e/Maybank2U

- Public Bank

- RHB Bank

2. Cheque deposit kiosks

- Payment via cheque deposit is available at CIMB Bank’s kiosks.

3. POS Malaysia

- You can make payment in cash at POS Malaysia counters.

Alternatively, payroll software users can submit and pay PCB by uploading a PCB file via their bank portal instead of uploading via e-Data PCB LHDN portal.

How to notify LHDN when employees join or leave my company?

Employers in Malaysia are required to adhere to specific procedures regarding employee notifications to LHDN:

- Notification for New Employee: Form CP22 serves as a notification for new employee who is (or is likely to be) subject to tax. The form must be submitted within 30 days of the commencement of the employment, either at the nearest LHDN office or online via e-CP22 in the MyTax portal.

- Termination of Service: Form CP22A serves as notification for cessation of employment in cases where tax clearance applies (e.g. PCB was not deducted or the employee received a termination payment). It should be submitted via e-SPC in the MyTax portal at least 30 days before cessation of employment. Any monies payable to the employee should be withheld until tax clearance is granted or for 90 days from submission.

Departure from Malaysia: Form CP21 serves as notification for departure from Malaysia for more than three months, requiring submission via e-SPC in the MyTax portal not less than 30 days before the anticipated departure date. Any monies payable to the employee should be withheld until tax clearance is granted or for 90 days from submission.

What are the employers’ responsibilities imposed by LHDN?

Employers have the following responsibilities:

- Register an employer’s (E) number.

- Obtain form TP3 from new employees to get the previous employment current year accumulated income and deduction data required for the PCB calculation.

- Allow employees to reduce their PCB by claiming optional tax deductions or tax rebates like zakat via form TP1.

- Make monthly PCB deductions from employees’ remuneration and remit them to the LHDN by the 15th of the following month.

- Submit Form E and CP8D by 31 March of the following tax year (or 30 Apr for online submissions via the MyTax portal) to provide LHDN with details of all employees’ income and deductions paid during the year.

- Provide Form EA to employees by the last day of February to provide them with the required income and deduction data should they need to submit a tax return.

- Submit relevant notification forms like CP22, CP22A and CP21.

- Withhold employee payments for 90 days if tax clearance is pending.

- Keep records for 7 years.

What are the penalties for non-compliance?

The Income Tax Act 1967 defines various offences and penalties associated with income tax compliance. Below are some of the significant offences, fines, and penalties to be aware of:

- Failure to Furnish Return or Give Notice of Chargeability: Failure to submit a return or notice of chargeability without a valid excuse under Section 112(1) may lead to a penalty, ranging from RM200 to RM20,000, imprisonment for a maximum of six months, or both.

- Incorrect Returns: Under section 113(1)(b), providing inaccurate returns or information can result in fines ranging from RM1,000 to RM10,000, in addition to a special penalty double the tax amount undercharged due to the inaccurate information.

- Wilful Evasion: Deliberate efforts to evade taxes, such as concealing income, providing false information, or committing fraud, can lead to fines between RM1,000 to RM20,000, a maximum three-year imprisonment, or both. Furthermore, a special penalty of triple the amount of undercharged tax could also be enforced under Section 114(1).

Important Cautionary Note

This content is provided for informational purposes only. While we make every effort to ensure the accuracy of the information presented, we cannot guarantee that it is free of errors or omissions. Users are advised to independently verify any critical information and should not solely rely on the content provided.