A Guide to PCB Deductions in Malaysia

What is PCB in Malaysia?

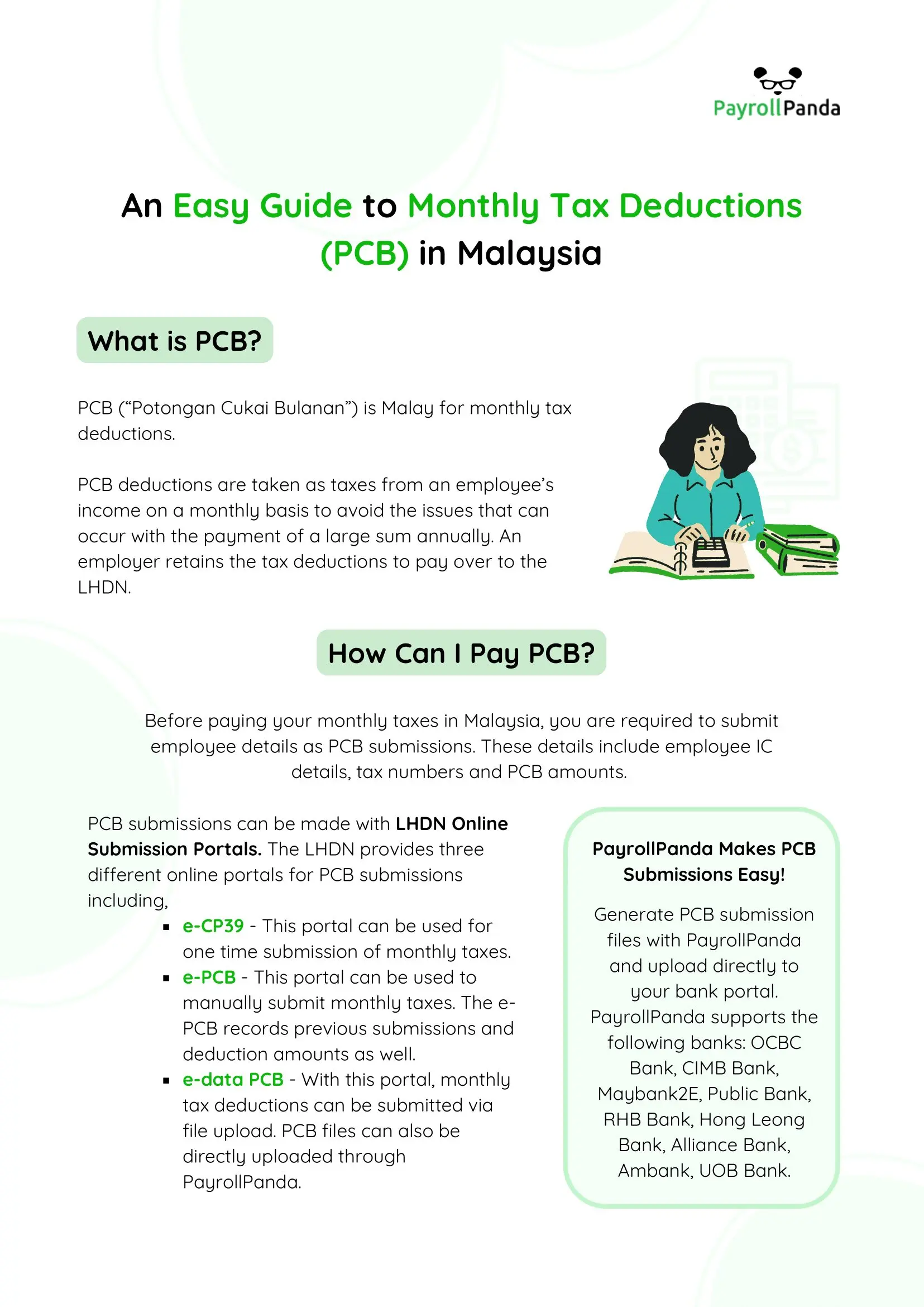

PCB (Potongan Cukai Bulanan) is Malaysia’s monthly tax deduction system, administered by the Inland Revenue Board (LHDN).

It was introduced to ensure employees’ income tax is collected gradually over the year instead of requiring a lump sum payment at the end of the year.

By deducting taxes monthly, employees can manage their finances more effectively, and the government ensures a consistent flow of tax revenue.

Learn more with our complete guide to PCB deductions for employers.

Monthly tax deductions in Malaysia are calculated based on the employee’s gross monthly income including; Employers are responsible for the calculation and deduction of correct PCB amounts from employee salaries. The deducted amount is then submitted to the LHDN by the employer on behalf of the employee. How is PCB Calculated?

When Must PCB be Submitted to the LHDN?

PCB must be submitted monthly by the 15th of the following month. Employers are required to provide a full submission of all employees’ PCB deductions along with relevant forms and reports.

Late submission can result in fines, interest charges, and even legal action in severe cases.

Download the following guide to understand PCB submissions and payment methods in Malaysia.

Payroll Panda’s guide about PCB submissions and payment methods in Malaysia