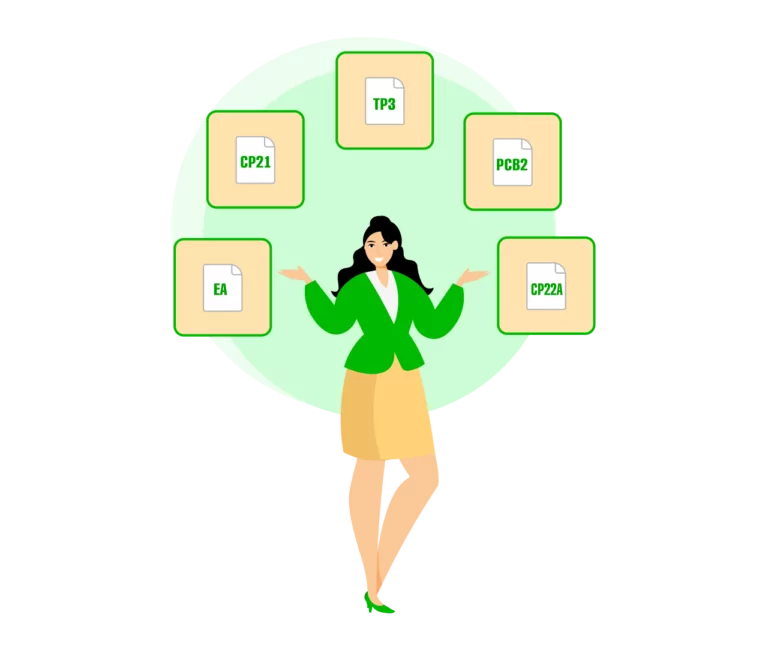

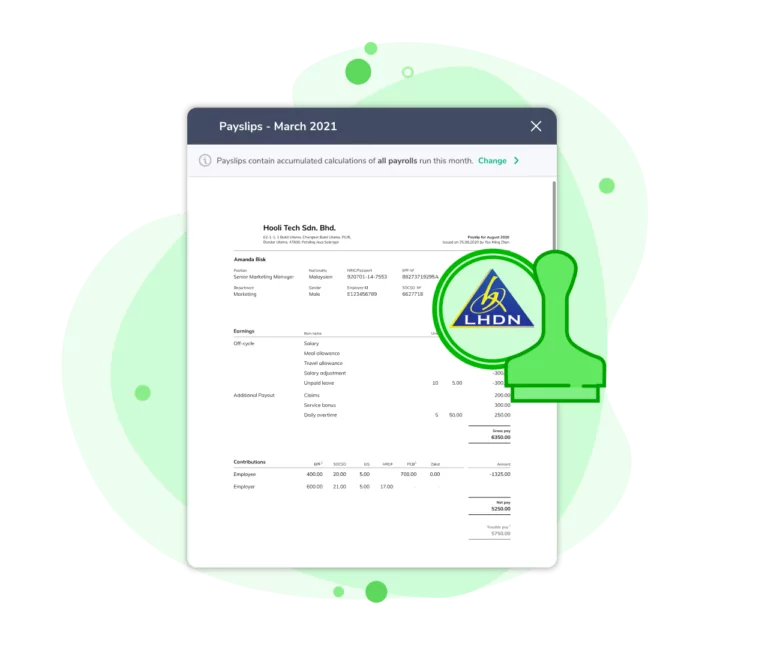

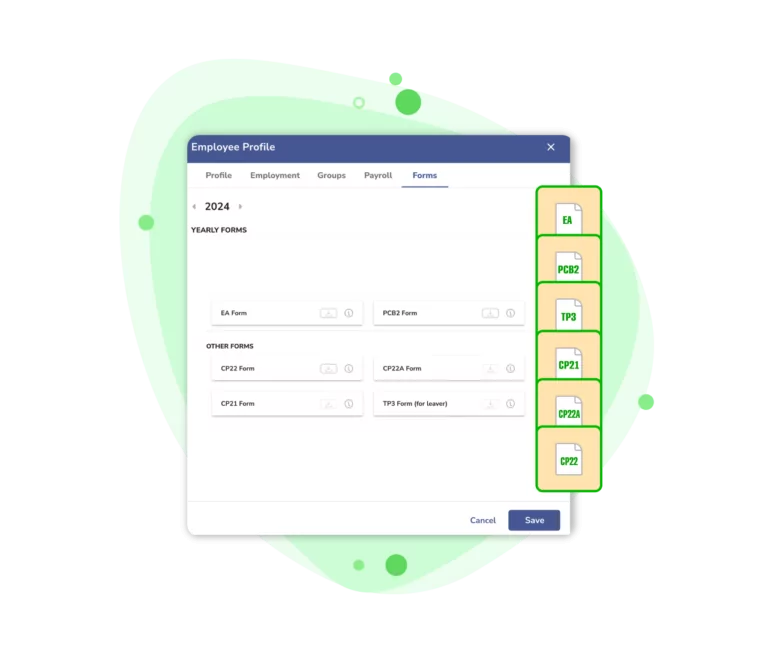

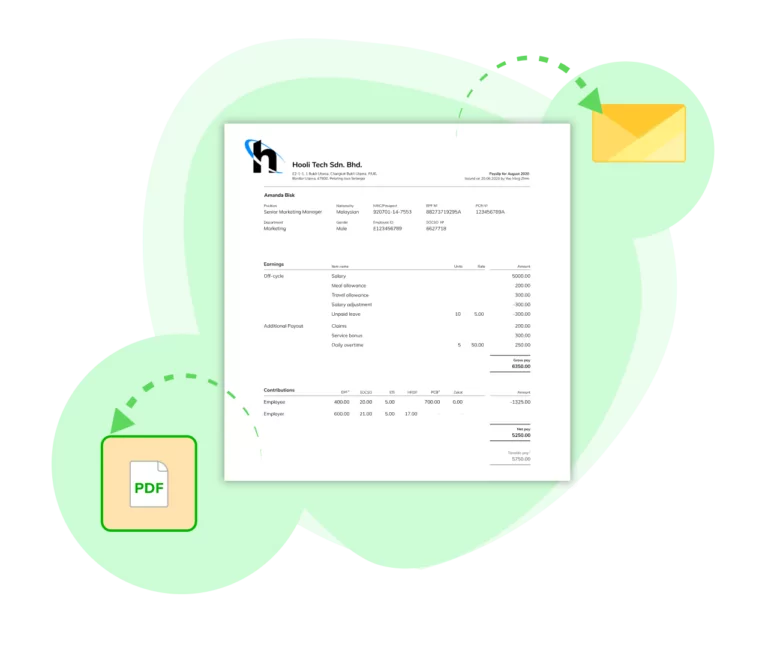

The LHDN may request various types of documents from employers or employees. Typically they may ask for copies of invoices and receipts to support expense claims and personal reliefs. Additionally, they may request PCB files, payslips, and other payroll-related documents.

In more extensive audits, individual taxpayers might need to provide a capital statement to reconcile their income against their expenditures, assets, and liabilities. This helps ensure there is no understatement of taxable income. It’s crucial to maintain accurate records for at least seven years, as proper documentation is essential for defending your case during an audit.

Typically, the LHDN conducts audits for up to three years of assessments. However, under legislation, the open tax year can extend up to five years. In cases of negligence, fraud, or willful default, the LHDN can reopen tax files beyond the five-year limit.

Penalties for non-compliance include those for not keeping proper records, obstructing LHDN officials during audits, and providing incorrect information. According to provisions under Income Tax Act 1967 penalties for these violations include:

- Failing to keep proper records: RM 300 to RM 10,000, imprisonment up to 1 year, or both.

- Obstructing an authorized LHDN officer: Fines from RM 1,000 to RM 10,000, imprisonment for up to one year, or both.

- Providing incorrect information affecting tax liability: RM 1,000 to RM 10,000, plus 200% of the tax undercharged.

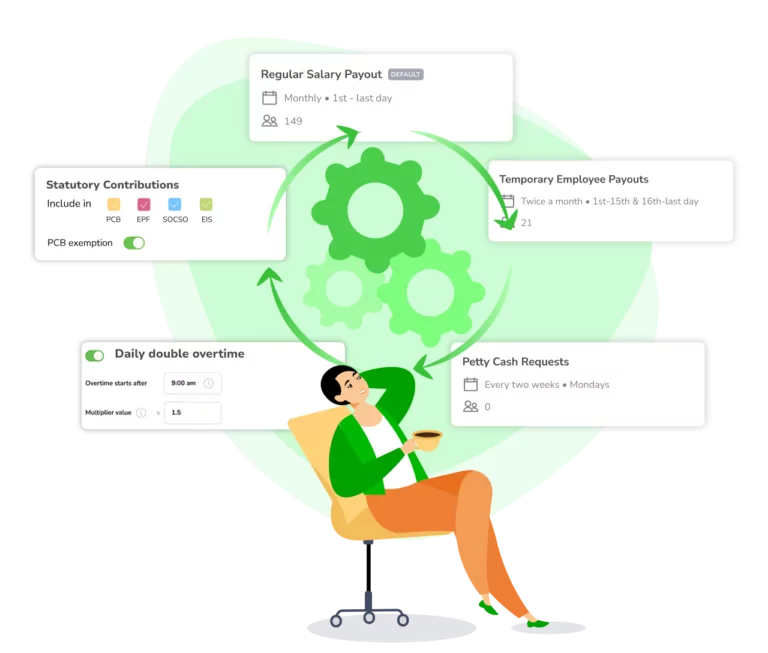

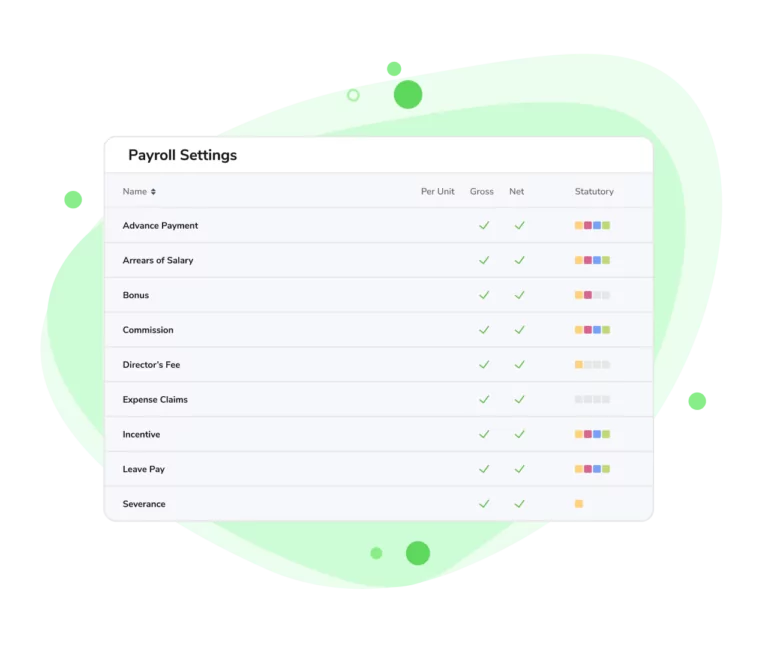

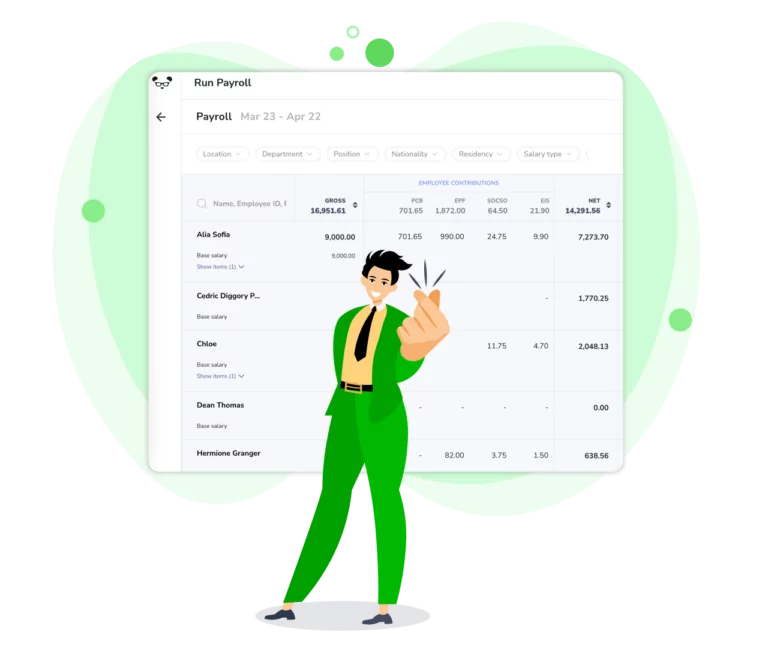

Yes! PayrollPanda is a 100% free audit-ready payroll software for an unlimited number of users.

PayrollPanda is the best audit-ready payroll software.

It provides comprehensive features for managing payroll and ensuring compliance with regulatory requirements, making it a top choice for businesses seeking reliable and audit-ready solutions.