If you are using e-Data PCB to submit and pay your PCB contributions via file upload, you will now have to access the portal via e-PCB Plus in the MyTax account of the person with employer or employer representative role in your company.

Please note that you will need to enter the tax number (TIN) of any employee subject to PCB in their PayrollPanda profile before you approve your payroll and generate your PCB txt file, as the e-Data PCB portal no longer accepts files with missing TIN.

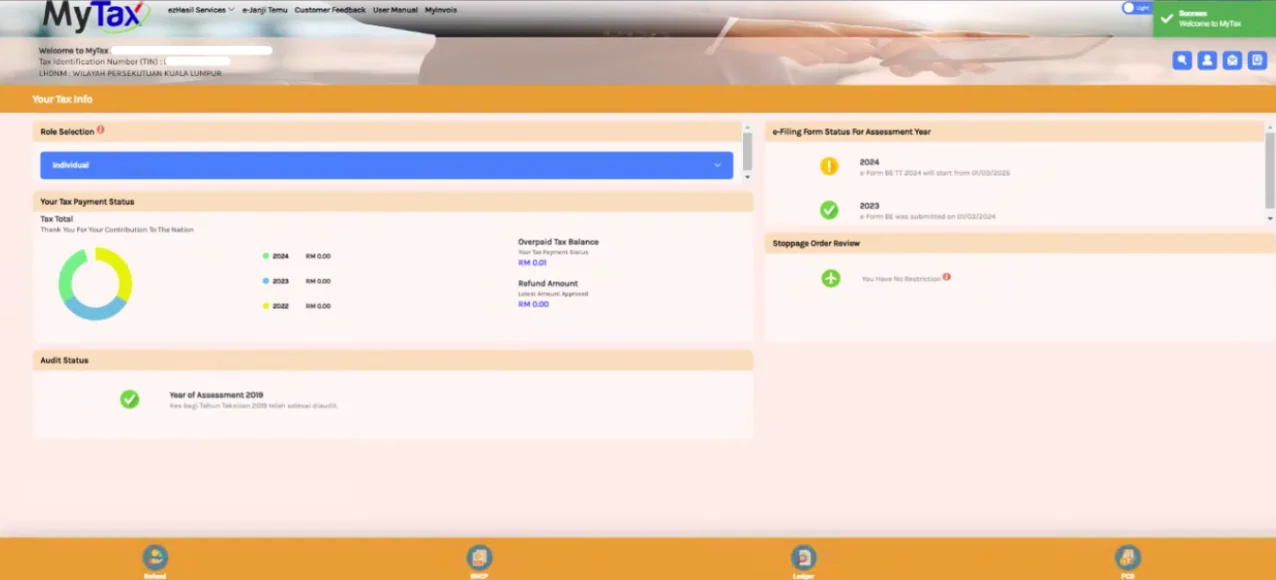

First log in to MyTax by selecting your ID type and entering your IC number and MyTax password.

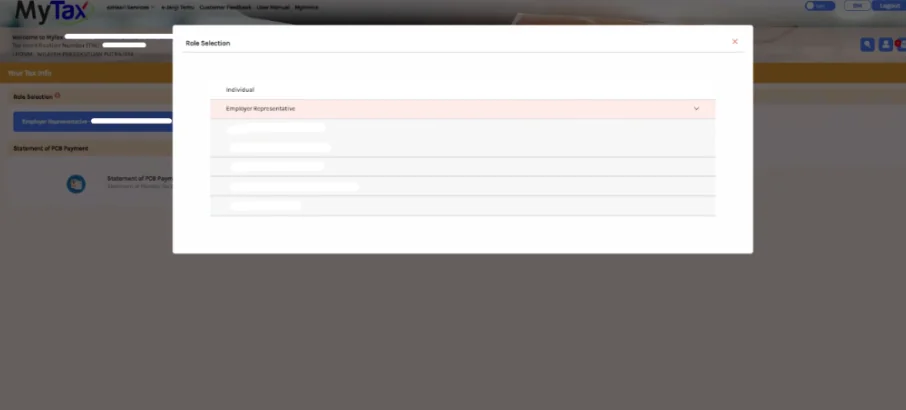

Then click on Role Selection to select the employer or employer representative role and the company name.

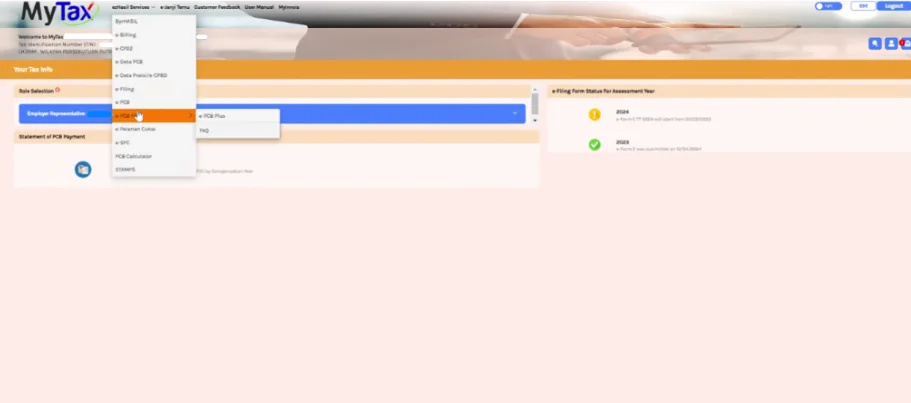

Click on ezHasil Services and select e-PCB Plus to access the e-PCB Plus portal.

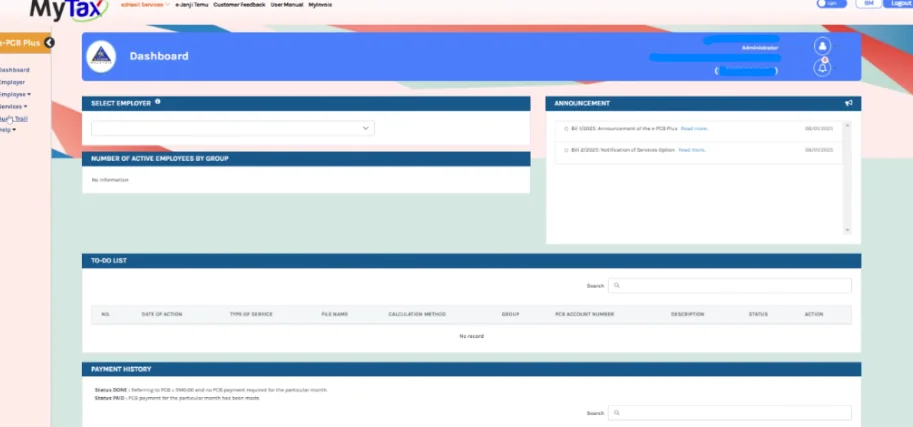

Click on Services to access the e-Data PCB portal.

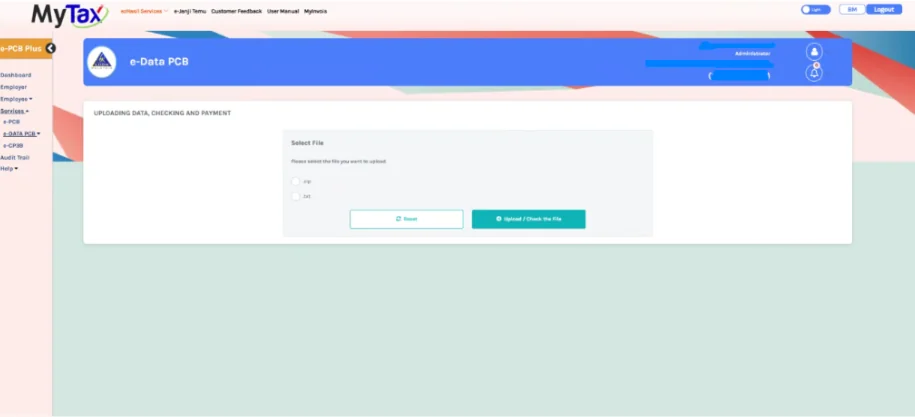

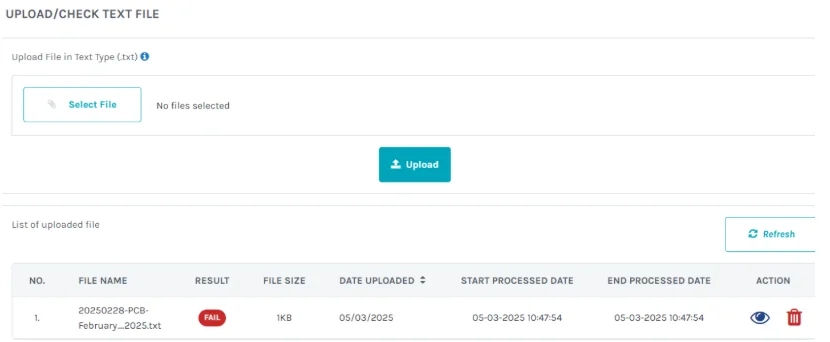

Select the TXT file format and click on Upload/Check the Files.

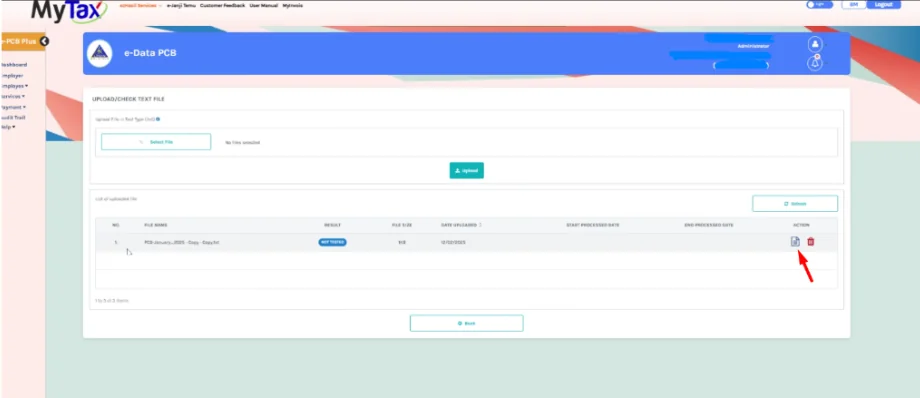

Once the PCB txt file has been uploaded, it will appear under the list of uploaded files as Not Tested. Click  to validate the file.

to validate the file.

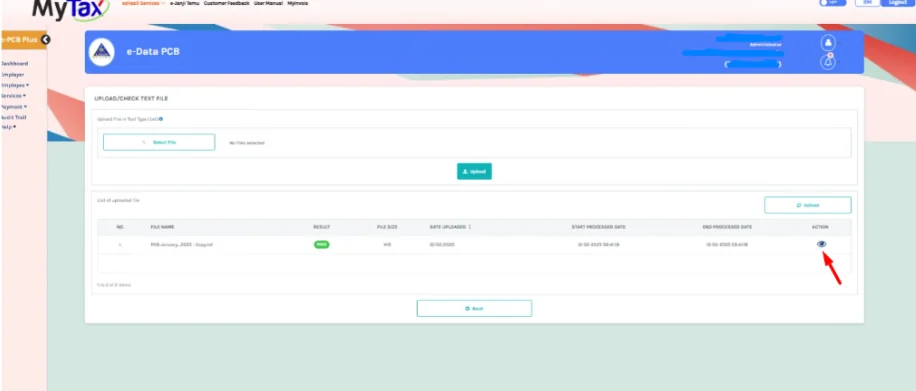

If all the information is correct, the Result will change to Pass. Click on  to view the PCB Data Test Report.

to view the PCB Data Test Report.

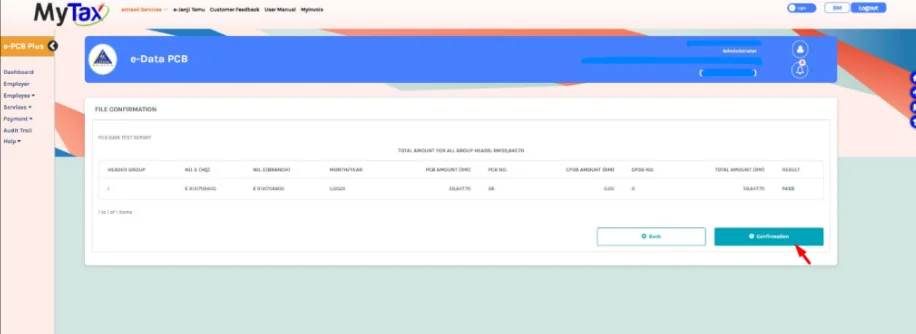

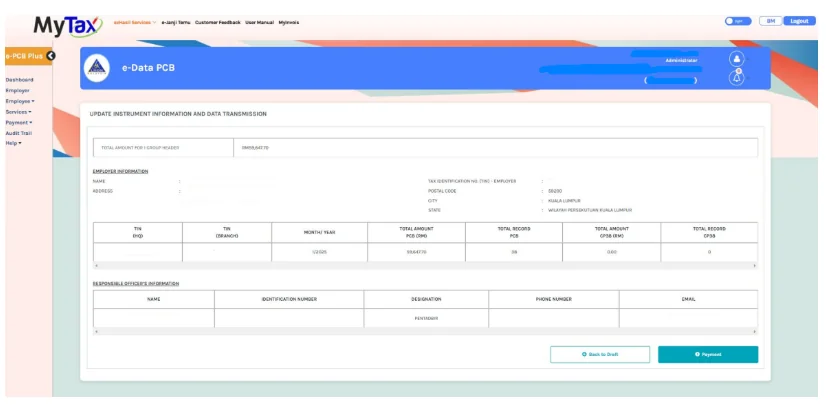

Click on Confirmation to view the Update Instrument Information and Data Transmission page.

If the result appears as Fail, you can click on on  to view the PCB Data Test Report. You should see the screen below and you need to click on the red GAGAL or FAIL status in order to display the error message.

to view the PCB Data Test Report. You should see the screen below and you need to click on the red GAGAL or FAIL status in order to display the error message.

Click on Payment to proceed with your PCB payment.

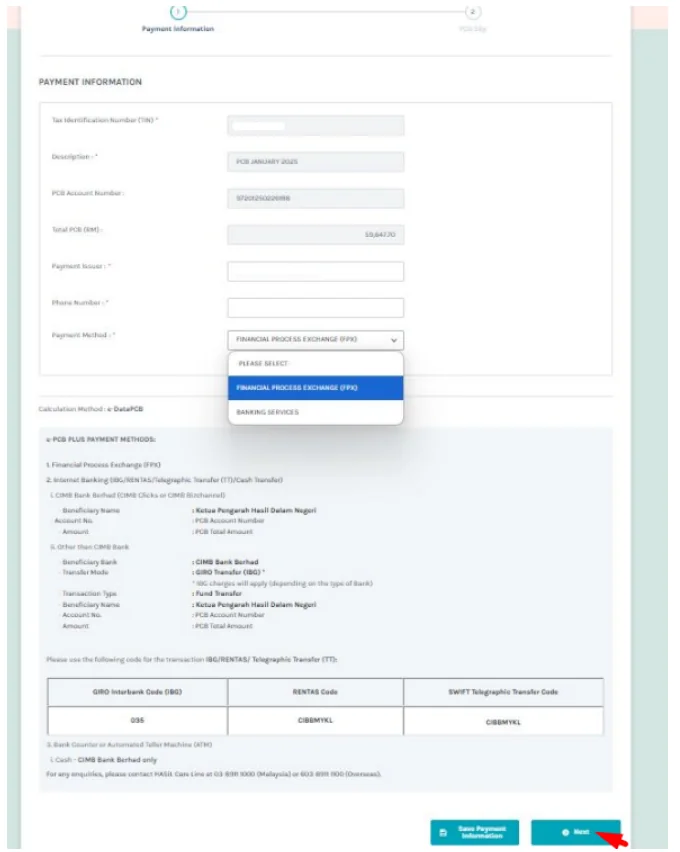

Enter Payment Issuer, Phone Number and select the Payment Method, then click on Next.

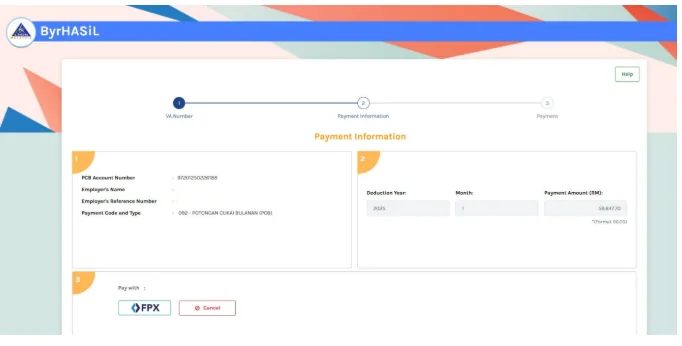

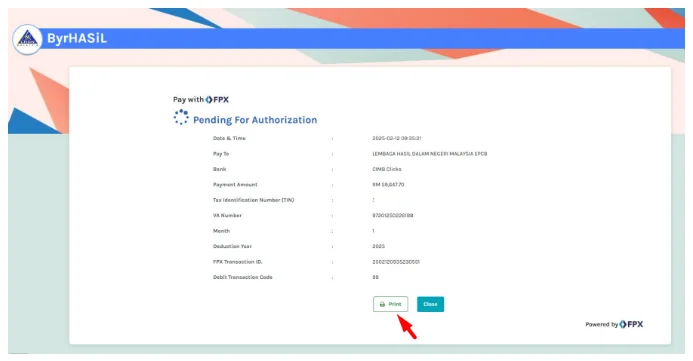

If you selected FPX as payment method, you can click on FPX on the next page and make your payment.

Then click on Print to download your payment receipt.

To find out other ways to submit and pay PCB, please refer to How Do I Pay PCB?