Malaysia Payroll Checklist

What is a Payroll Checklist?

In Malaysia, a payroll checklist is a structured guide to help employers ensure that payroll processes are accurate, compliant, and timely.

It covers statutory requirements under Malaysian law, including EPF (KWSP), SOCSO (PERKESO), EIS, and PCB (monthly tax deductions), while also managing salaries, allowances, bonuses, overtime, and deductions.

A comprehensive payroll checklist typically includes:

Using a payroll checklist helps Malaysian employers avoid compliance issues, payroll errors, and potential fines from statutory authorities. It improves operational efficiency, ensures timely submission of contributions, and maintains accurate records for audits. A structured payroll process also enhances employee trust, reduces disputes, and supports long-term HR and financial planning. Payroll professionals must also stay informed about updates in tax regulations and employment policies, which can change frequently. What Should Be Included in a Payroll Checklist?

Why is a Payroll Checklist Important?

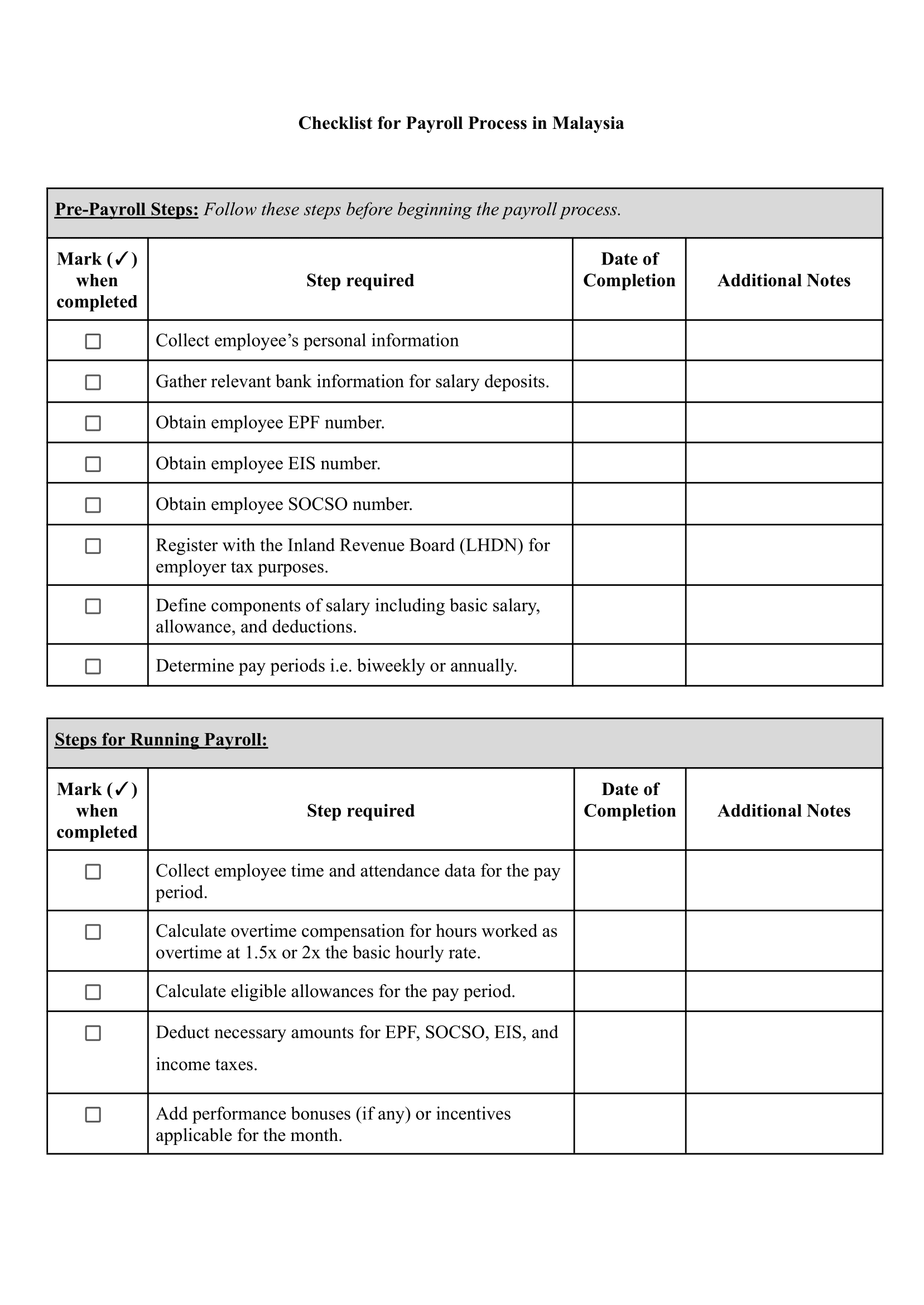

The following payroll checklist offers a step-by-step guide to help you effectively run payroll in Malaysia.

Payroll Panda’s Checklist for Payroll Process in Malaysia