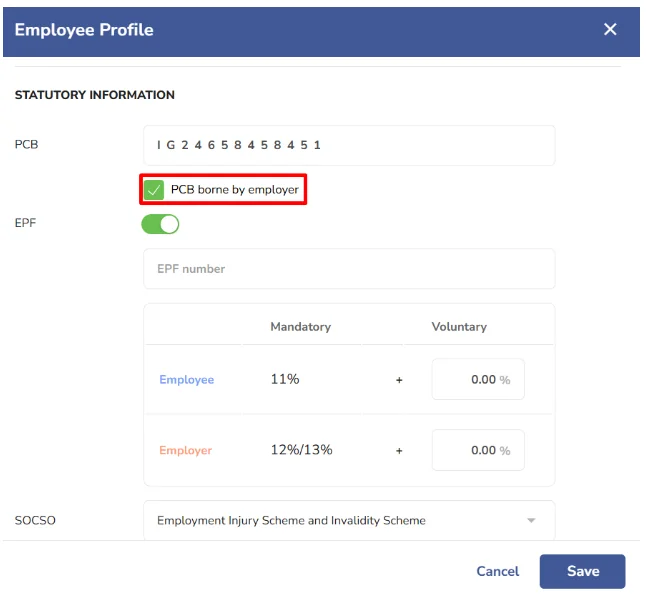

PCB contributions are normally deducted from employees’ pay since they are monthly deductions aimed at settling an employee’s income tax liability. In rare cases (for example, expatriates temporarily assigned to a Malaysian company), employers may decide to bear the cost of the PCB on behalf of the employee by not deducting it from their salary. By ticking PCB borne by employer in an employee’s profile, the PCB will be calculated as usual but it will not be deducted from the employee’s salary.

Since the employee is effectively receiving a higher salary when the PCB is not deducted from their pay, any PCB borne by the employer represents a taxable benefit to the employee which should be added to the employee’s taxable income in the following tax year, as specified by LHDN. For example, if PCB is borne by the employer in 2024, the amount of PCB paid in 2024 should be added to the employee’s 2025 taxable income and PCB should be paid on that benefit. In PayrollPanda, the taxable amount will automatically be added to Jan 2025 payroll for the employee so that additional PCB can be calculated on that benefit.

It is expected that in January in the following year, the taxable income will be higher due to the additional benefit added to the payroll under PCB Borne by Employer in Previous Year.