End of Month Payroll Checklist

What Is End-of-the-Month Payroll?

End of month payroll processing involves the calculation and distribution of employee salaries at the end of a particular month. Streamlined payroll processing ensures that employees are rightfully compensated, maintaining morale and trust.

In Malaysia, month-end payroll must comply with local labour and tax regulations, ensuring employees are paid accurately and on time.

What Tasks Are Involved in End-of-the-Month Payroll?

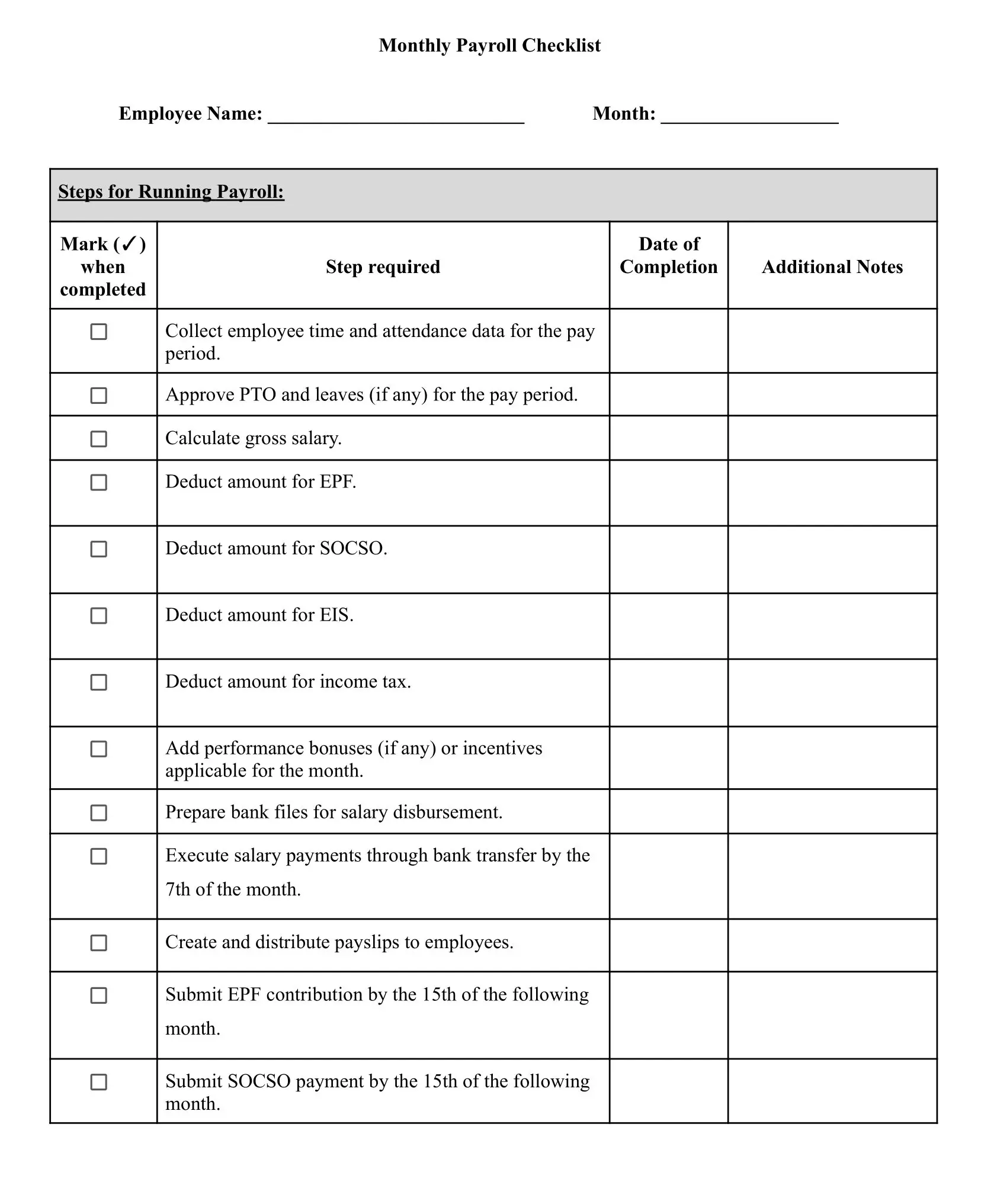

The process begins with collecting employee timesheets and attendance records. Deductions for taxes, benefits, and other withholdings, such as EPF (KWSP), SOCSO (PERKESO), EIS, and PCB, are applied to the gross pay to determine net pay.

Once calculations are complete, deposits are made directly to the employees’ accounts. Any adjustments, such as unpaid leave or bonuses, should also be processed before payroll is finalised.

The following document includes the steps required for processing monthly payroll in Malaysia.

Payroll Panda’s Monthly Payroll Checklist