EIS Contribution Rates Malaysia

What Is the Employment Insurance System (EIS) in Malaysia?

The Employment Insurance System (EIS) is a statutory social security scheme administered by SOCSO (PERKESO) under the EIS Act 2017.

It provides financial assistance and employment support to eligible employees who lose their jobs due involuntarily. Benefits include monthly allowances, job matching services, career counselling, and approved training programmes to help displaced workers return to employment. The scheme is an important part of Malaysia’s social security framework, providing employees a safety net and promoting economic stability and welfare.

What Benefits Can Employees Claim Under EIS?

Eligible employees who lose their jobs may receive:

- Job search allowance (temporary income support)

- Early re-employment allowance

- Reduced income allowance

- Training allowance and re-skilling programmes

- Career counselling and job placement services

These benefits are designed to support employees financially while improving their chances of re-employment.

Who Is Covered Under EIS Contributions?

EIS coverage is mandatory for Malaysian citizens and permanent residents employed in the private sector under a contract of service. Both employers and employees must contribute, regardless of employment type (full-time or contract), provided the employee meets eligibility criteria. Foreign employees and public sector workers are generally excluded from EIS contributions.

How Are EIS Contributions Calculated?

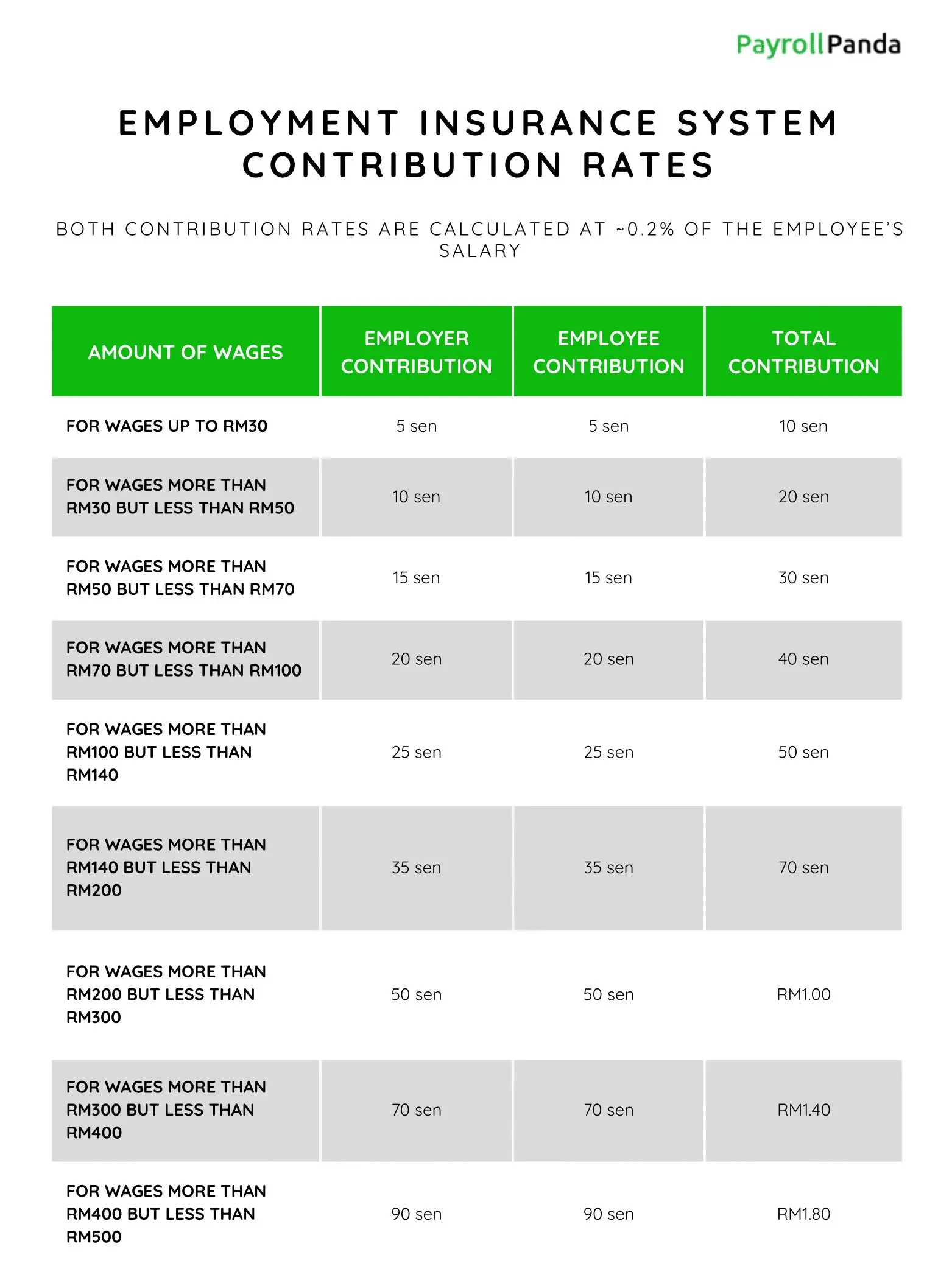

EIS contributions are calculated based on an employee’s monthly salary, with 0.2% contributed by the employer and 0.2% by the employee. Contributions are subject to a monthly wage ceiling as prescribed by SOCSO. Employers are responsible for calculating the correct amounts and deducting the employee’s share from wages each month.

When Must Employers Submit EIS Contributions?

EIS contributions must be submitted by the 15th of the following month, together with SOCSO contributions. Late payment may result in interest charges, penalties, or enforcement action. Timely submission is crucial to maintain compliance and protect employee eligibility for benefits.

The poster provided displays a detailed breakdown of the contribution rates required by the program, according to different wage brackets.

Payroll Panda’s poster of EIS contribution rates in Malaysia